Showing 1 - 10 of 16

Fitch says durable coalition crucial to fiscal outlook

Business, Somruedi Banchongduang, Published on 12/02/2026

» A durable coalition will be critical to Thailand's post-election fiscal outlook and would help reduce the risk of a sovereign rating downgrade, says Fitch Ratings.

Baht facing unstable week amid upheaval

Business, Somruedi Banchongduang, Published on 02/09/2025

» Greater baht volatility is expected this week, pressured by domestic political instability and expectations of a US policy rate cut later this month.

KBank keeps vow to customers

Business, Somruedi Banchongduang, Published on 28/09/2024

» Despite abundant challenges, Kasikornbank (KBank), Thailand's third-largest lender by total assets, remains committed to supporting vulnerable clients in managing their debt throughout the lifetime of their loans.

Owed a real debt of gratitude

News, Somruedi Banchongduang, Published on 22/03/2022

» Nayanee Peaugkham, 54, has spent more than 20 years honing her experience in financial services.

BoT revises growth forecast to 1.8%

Business, Somruedi Banchongduang, Published on 24/06/2021

» The Bank of Thailand (BoT) has slashed the country's economic growth forecast again for this year to 1.8% from an earlier projection of 3%, due to lower foreign tourist arrival estimates and lower domestic demand due to the third wave of Covid-19.

BoT vows study of consumption habits

Business, Somruedi Banchongduang, Published on 10/04/2021

» The Bank of Thailand pledges to keep a close watch on the fresh wave of Covid-19 infections and, in particular, the government's measures in containing the infections as well as people's consumption behaviour.

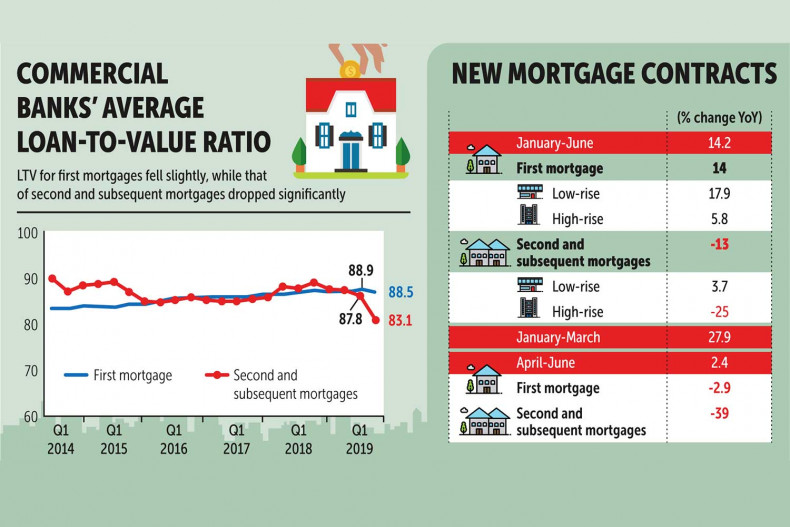

Second mortgages fall hard after LTV curbs tame market

Business, Somruedi Banchongduang, Published on 11/10/2019

» Second and subsequent new mortgages, particularly for condo purchases, plunged 39% year-on-year in the three months to June after the central bank's tougher loan-to-value (LTV) regulations came into force in April.

BoT keeps options open

Business, Somruedi Banchongduang, Published on 18/07/2019

» The Bank of Thailand says the impact of a policy rate cut to tame offshore fund inflows would be limited and it stands ready to enact additional measures if recent moves fail to contain the baht.

Thailand sidesteps US watch list

Business, Somruedi Banchongduang, Published on 30/05/2019

» Although Thailand managed to avoid a place on the US watch list for currency manipulation, the Bank of Thailand is still wary on the matter after the US Treasury tightened its criteria, says the central bank's chief.

BoT prepares for US manipulation listing

Business, Somruedi Banchongduang, Published on 17/05/2019

» Bank of Thailand governor Veerathai Santiprabhob has acknowledged the possibility that the US will add Thailand to a watch list for currency manipulation because of a high current account surplus, but not for stepping into the foreign exchange market for trade advantages.