Showing 1 - 10 of 82

Banker slams parties' household debt vows

Business, Somruedi Banchongduang, Published on 09/02/2026

» As political parties compete to offer quick relief for struggling households, a leading Thai banker warns the country's debt crisis cannot be resolved with tax revenues or government spending alone.

Central bank anticipates growing uncertainty

Business, Somruedi Banchongduang, Published on 08/01/2026

» The Bank of Thailand expects the recent US military operation in Venezuela to heighten global uncertainty in three areas -- military, trade and finance -- this year and next.

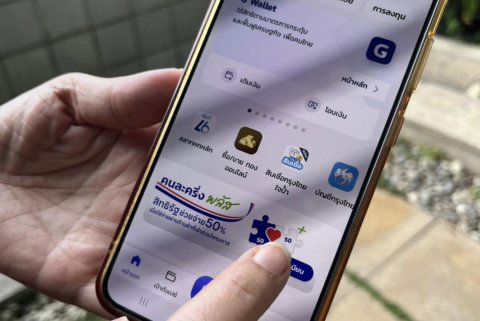

BoT predicts stimulus drives GDP growth in Q4

Business, Somruedi Banchongduang, Published on 23/10/2025

» The Bank of Thailand expects the "Khon La Khrueng Plus" co-payment scheme to help drive GDP growth in the final quarter this year.

New Bank of Thailand chief pledges more help for household debtors

Somruedi Banchongduang, Published on 10/10/2025

» The new governor of the Bank of Thailand has vowed to focus more on targeted measures alongside monetary policy to deliver tangible results and provide meaningful support to the public.

Bank chief calls for economic reform

Business, Somruedi Banchongduang, Published on 06/09/2025

» Piti Tantakasem, chief executive at TMBThanachart Bank (ttb), has urged structural economic reform to enable the country to withstand persistent political instability.

Fears over sovereign rating revision

Business, Somruedi Banchongduang, Published on 05/09/2025

» Bankers are increasingly concerned about a potential downgrade of the country's sovereign credit rating in the near future due to weakening tax revenues and rising public debt.

Thai central bank sees 18 months of sub-2% growth

Business, Somruedi Banchongduang, Published on 10/07/2025

» The Bank of Thailand has assessed the Thai economy is likely to grow at a rate of less than 2% over the next 18 months, primarily due to pressures from US tariff policies.

US tariffs force ttb to conduct stress tests

Business, Somruedi Banchongduang, Published on 23/04/2025

» TMBThanachart Bank (ttb) has initiated stress tests to gauge the risks and potential impacts of US tariffs on Thai exports.

TMBThanachart dismisses Krungthai merger rumour

Somruedi Banchongduang, Published on 21/03/2025

» TMBThanachart Bank (ttb) has denied rumours of a merger with Krungthai Bank (KTB) following reports in local media about a potential merger.

KBank, ttb aim to normalise credit costs

Business, Somruedi Banchongduang, Published on 20/03/2025

» Kasikornbank (KBank) and TMBThanachart Bank (ttb) want to normalise their credit costs this year by enhancing asset quality while maintaining stable loan growth.