Showing 1 - 7 of 7

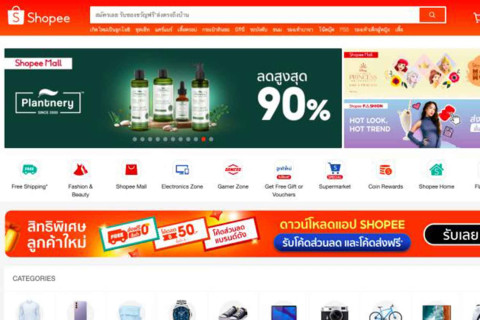

Shopee spurs rise in nanofinance

Business, Somruedi Banchongduang, Published on 01/09/2025

» The National Credit Bureau (NCB) reported strong growth in nanofinance outstanding loans in the second quarter of 2025, primarily driven by a new member -- Shopee e-commerce platform.

‘Buy now, pay later’ abuse under scrutiny

Somruedi Banchongduang, Published on 07/05/2024

» The National Credit Bureau (NCB) is calling on providers of buy now, pay later (BNPL) services to improve risk controls to prevent misuse of the system to create informal loans.

BBL outstrips credit card spending target for 2 months

Business, Somruedi Banchongduang, Published on 28/03/2023

» Bangkok Bank (BBL) has surpassed its credit card spending target for the first two months of 2023, driven by the recovery of Thailand's economy and tourism sector.

Krungsri targets rise in digital customers

Business, Somruedi Banchongduang, Published on 08/03/2023

» Krungsri Consumer, the unsecured loan unit under Bank of Ayudhya, aims to increase its customer base on digital platforms by 20% this year, aided by new digital service offerings.

LH Bank rebrands M Choice app

Business, Somruedi Banchongduang, Published on 11/11/2022

» Land and Houses Bank Plc (LH Bank) is upgrading and plans to rebrand its existing mobile banking application to offer a full range of services.

KBank, Carabao team up for loan service

Business, Somruedi Banchongduang, Published on 01/08/2022

» Kasikornbank (KBank) has joined hands with Carabao Group, the maker of Carabao Dang energy drink, on a plan to offer personal loans under the Kbao brand at Tookdee convenience stores.

Krungsri Consumer preps new service

Business, Somruedi Banchongduang, Published on 15/03/2022

» Krungsri Consumer, the unsecured loan unit under Bank of Ayudhya (BAY) that uses the marketing name Krungsri, plans to offer a new credit card service for customers to enable them to purchase goods first and pay the loan later.