Showing 1 - 10 of 10,000

Chinese shoppers are Asia's biggest airport spenders

South China Morning Post, Published on 23/02/2026

» HONG KONG — Chinese travellers are outspending their Asian peers at the region's airports in search of gifts, food and luxury purchases, a trade association has found.

US to stop collecting tariffs ruled illegal by Supreme Court

Reuters, Published on 23/02/2026

» WASHINGTON - The US Customs and Border Protection agency said it will halt collections of tariffs imposed under the International Emergency Economic Powers Act at 12.01am EST (12.01pm Thai time) on Tuesday, after the US Supreme Court declared the duties illegal.

Thailand sees upside to Trump court ordered US tariff reset

Published on 23/02/2026

» A reset of many US tariffs to a uniform 15% will strengthen Thailand’s appeal as a manufacturing and investment hub, according to Finance Minister Ekniti Nitithanprapas.

IRPC accelerates 4R strategy: “Recapitalise, Revitalise, Reframe, Reinvent”

Published on 23/02/2026

» IRPC Public Company Limited (IRPC) led by Terdkiat Prommool, President and Chief Executive Officer announced:

Thai exports jump most in four years on AI-led electronics boom

Published on 23/02/2026

» Outbound shipments of electronic products and stronger inbound demand for raw materials and machinery pushed Thailand’s exports and imports to their highest levels in four years, as the country seeks a trade agreement with the United States.

Bitcoin falls below $65,000

Bloomberg News, Published on 23/02/2026

» Bitcoin slid below US$65,000 in early Asia trading on Monday, roiled by fresh nervousness over the status of US tariffs.

Geopolitics, Volatility, and the Case for a Strong Trading Fortress

Published on 23/02/2026

» In a world connected at the speed of a fingertip, a troop movement on the other side of the globe or the signing of a trade agreement by major powers is no longer just foreign news buried in a newspaper column. It has become a trading signal, one that can impact your investment portfolio within seconds.

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

AFP, Published on 23/02/2026

» MILAN (ITALY) - International Olympic Committee president Kirsty Coventry lauded Milan-Cortina 2026 as a "new kind of Winter Games" as she declared them closed on Sunday.

US tariff game 'not yet over'

News, Somhatai Mosika, Published on 23/02/2026

» The US tariff game is escalating as President Donald Trump has now raised tariffs to 15%, prompting the Thai Chamber of Commerce (TCC) to urge exporters to brace for heightened volatility and call on the government to speed up negotiations.

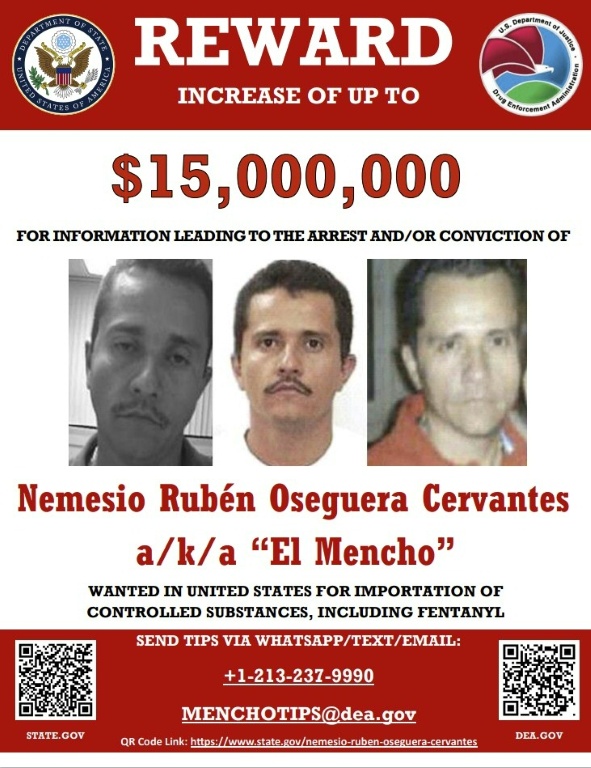

Top Mexican drug cartel leader killed

AFP, Published on 23/02/2026

» MEXICO CITY - Mexico confirmed on Sunday that soldiers killed a powerful drug cartel leader who was one of the most wanted men here and in the United States.