Showing 1 - 10 of 10

Thai bad debt soars to all-time high of B1.23 trillion

Published on 21/03/2025

» Bad household debt in Thailand has risen by 25% since the end of 2022, reaching a record-high 1.23 trillion baht as of January this year, according to the National Credit Bureau (NCB).

Co-op, nano-finance loans gain in Q2

Business, Published on 05/09/2024

» Co-operative (co-op) and nano-finance loans grew significantly in the second quarter of 2024, driven by retail borrowers seeking additional liquidity to cover expenses as access to bank loans became more challenging.

BAM eager to keep lead in distressed assets sector

Business, Somruedi Banchongduang, Published on 18/05/2024

» Bangkok Commercial Asset Management (BAM), Thailand's largest asset management company, set an ambitious goal for bad asset management over the next few years in a bid to address the burden of distressed debts within the banking industry.

Troubled debt set to exceed B1tn

Business, Somruedi Banchongduang, Published on 29/11/2023

» The National Credit Bureau (NCB) estimates by year-end, debts in the troubled debt restructuring (TDR) programme could exceed 1 trillion baht as a result of the weaker repayment ability of borrowers.

Troubled debt set to exceed B1 trillion

Somruedi Banchongduang, Published on 28/11/2023

» The National Credit Bureau (NCB) has estimated by year-end, debts in the troubled debt restructuring (TDR) programme could exceed 1 trillion baht as a result of the weaker repayment ability of borrowers.

Data, AI driving firm's new guise

Business, Somruedi Banchongduang, Published on 12/09/2023

» SET-listed Bangkok Commercial Asset Management Plc (BAM) is transforming into a data and AI-driven organisation to strengthen its business operations amid the digital era.

Credit bureau: Bad loans exceeded B1tn in Q2

Business, Somruedi Banchongduang, Published on 10/08/2023

» Non-performing loans (NPLs) measured by the National Credit Bureau reached 1 trillion baht in the second quarter this year, the highest in 12 months, says a bureau executive.

These Gas-Station Entrepreneurs Favored Food Over Fuel and Got Rich

Business, Published on 08/12/2020

» Two brothers who became billionaires in Britain by focusing on food over fuel at gas stations are looking to roll out that model globally in the hope of finding broader success.

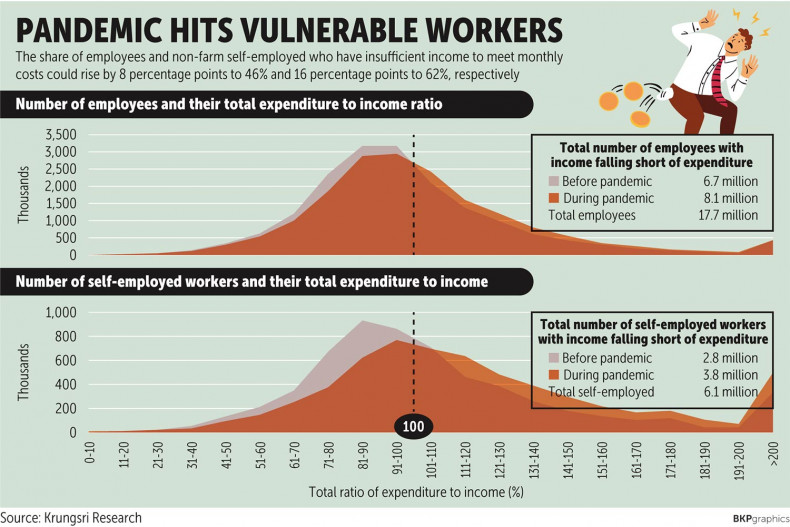

Household debt risks boiling over

Business, Somruedi Banchongduang, Published on 23/05/2020

» The country's household bad debt is expected to reach 1 trillion baht this year, putting the ratio to total loans outstanding into double digits as debt-servicing ability erodes amid coronavirus-induced income shocks, says the head of the National Credit Bureau (NCB).

SME debt scheme hampers loan access

Business, Somruedi Banchongduang, Published on 12/05/2020

» The troubled debt restructuring (TDR) scheme offered to small and medium-sized enterprises (SMEs) was affected by subpar economic growth, a stumbling block for many firms in accessing additional lending as well as the central bank's sponsored soft loans, says the head of the National Credit Bureau (NCB).