Showing 1 - 10 of 10,000

UN Sudan probe finds ‘hallmarks of genocide’

AFP, Published on 19/02/2026

» GENEVA - The United Nations’ independent fact-finding mission on Sudan said Thursday the paramilitary siege and capture of El-Fasher bore “the hallmarks of genocide”.

Chinese grey network ‘still active’ in Cambodian border zone

Online Reporters, Published on 19/02/2026

» The Royal Thai Navy (RTN) says it has uncovered a Chinese grey business network operating near the Cambodian border district of Thmor Da, where foreign nationals have been forced to work in online scam operations.

Arctic island Svalbard also wary of great powers

AFP, Published on 19/02/2026

» LONGYEARBYEN, Svalbard - There are no outward signs of jitters, at least not yet: people in Svalbard are going about their daily lives as normal despite speculation that this Norwegian archipelago could be the next Arctic territory coveted by the United States or Russia.

General strike protests labour reforms in Argentina

AFP, Published on 19/02/2026

» BUENOS AIRES - Argentine President Javier Milei faces the fourth general strike of his term Thursday, this time by workers protesting a labour reform bill pushed by the budget-slashing president and set to be debated in parliament.

Taliban ‘beard police’ pursue Afghan barbers

AFP, Published on 19/02/2026

» KABUL - Barbers in Afghanistan risk detention for trimming men’s beards too short, they told AFP, as the Taliban authorities enforce their strict interpretation of Islamic law with increasing zeal.

Denmark's King Frederik in Greenland for symbolic show of support

AFP, Published on 19/02/2026

» NUUK - Denmark's King Frederik X arrived in Greenland on Wednesday for a three-day visit in a show of support for the autonomous Danish territory coveted by US President Donald Trump.

Trump kicks off his 'Board of Peace,' with eye on Gaza and beyond

AFP, Published on 19/02/2026

» WASHINGTON (UNITED STATES) - US President Donald Trump on Thursday gathers allies to inaugurate the "Board of Peace," his new institution focused on progress on Gaza but whose ambitions reach much further.

Thailand reviewing visa-free stays as local complaints pile up

Gary Boyle, Published on 19/02/2026

» Thailand’s caretaker government is considering a reduction of the 60‑day visa‑free stay period, following numerous complaints that foreigners have been exploiting the system to engage in illegal activities or exploit local residents, according to Foreign Affairs Minister Sihasak Phuangketkeow.

Chiang Mai airport sees traffic spike

News, Published on 19/02/2026

» Chiang Mai International Airport has recorded a new post-Covid high in passenger traffic, with daily numbers surpassing 36,000, as airlines added 69 extra and charter flights to accommodate Lunar New Year demand.

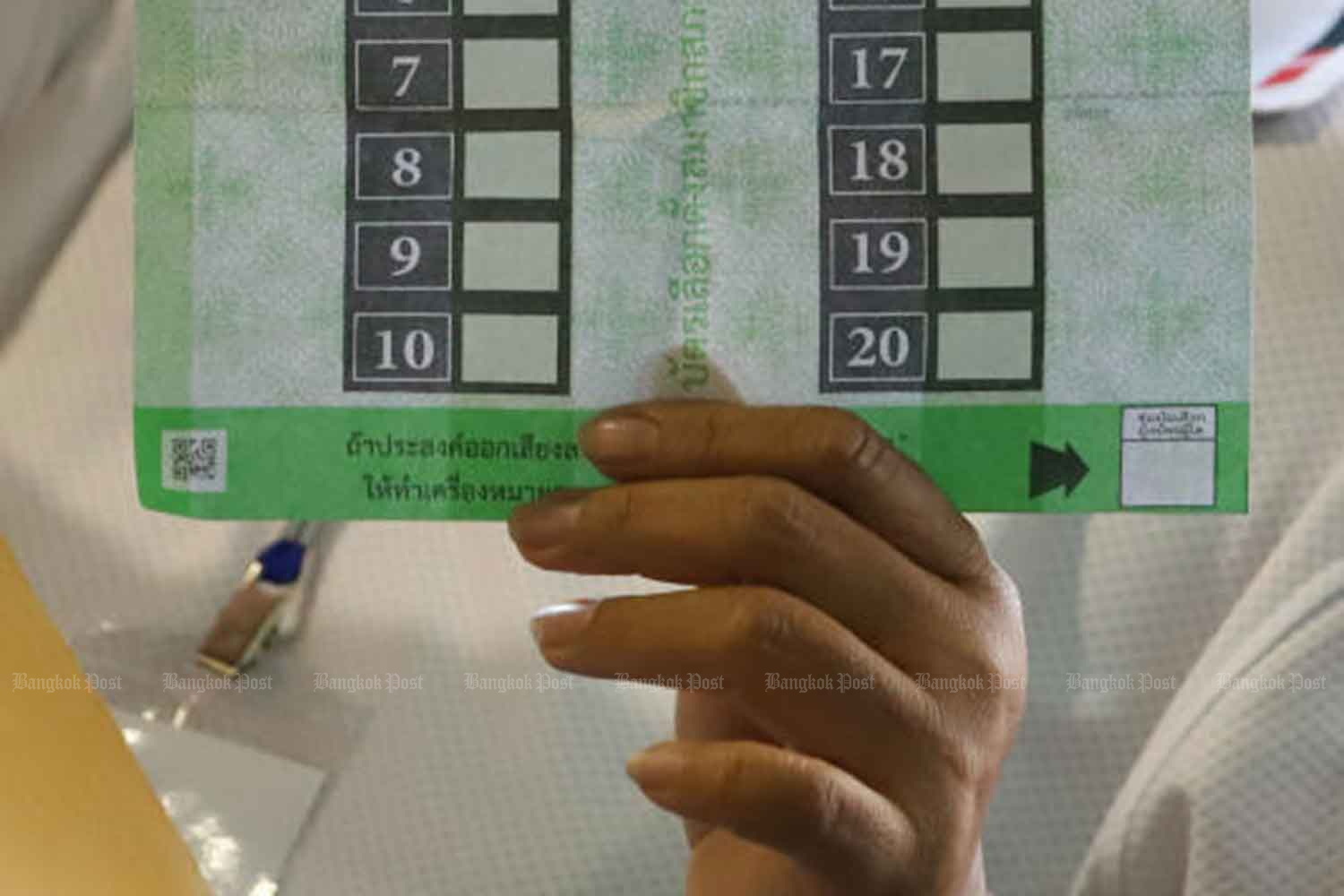

EC stands by ballot safeguards

Chairith Yonpiam, Published on 19/02/2026

» The Election Commission (EC) has reaffirmed the confidentiality of ballots, with provincial election officials adamant that voting secrecy remains fully protected under legal safeguards and administrative procedures, amid growing public debate over the use of QR codes and barcodes on ballot papers.