Showing 1 - 10 of 14

BAAC upgrades app in bid to become a digital entity

Business, Wichit Chantanusornsiri, Published on 02/11/2022

» The Bank for Agriculture and Agricultural Cooperatives (BAAC) has upgraded its A-Mobile banking app's capacities and renamed it A-Mobile Plus to facilitate rising numbers of customers and transactions.

BAAC aims for B20bn in digital loans

Business, Wichit Chantanusornsiri, Published on 18/04/2022

» The Bank for Agriculture and Agricultural Cooperatives (BAAC) wants to extend digital lending of 20 billion baht this year through its mobile banking application, says bank president Tanaratt Ngamvalairatt.

Banking on technology

Business, Wichit Chantanusornsiri, Published on 01/11/2021

» State agencies and state-run banks have been harnessing technology to enhance their performance, ranging from analysing suspicious tax evasion cases to facilitating bank customers conducting a live chat to request a loan.

BAAC boasts uptick in app usage

Business, Wichit Chantanusornsiri, Published on 06/09/2021

» The number of active users on the Bank for Agriculture and Agricultural Cooperatives' (BAAC) mobile app has soared to 50% of its total 2.73 million userbase, says president Tanaratt Ngamvalairatt.

GSB to unveil mobile lending in 2021

Business, Wichit Chantanusornsiri, Published on 03/11/2020

» The Government Savings Bank (GSB) expects loan approvals through its mobile banking application and microfinance lending to launch next year.

BAAC seeks 50% gain in mobile users

Business, Wichit Chantanusornsiri, Published on 10/02/2020

» The state-owned Bank for Agriculture and Agricultural Cooperatives (BAAC) aims for 50% growth in mobile banking users to 1.2 million for its next financial year.

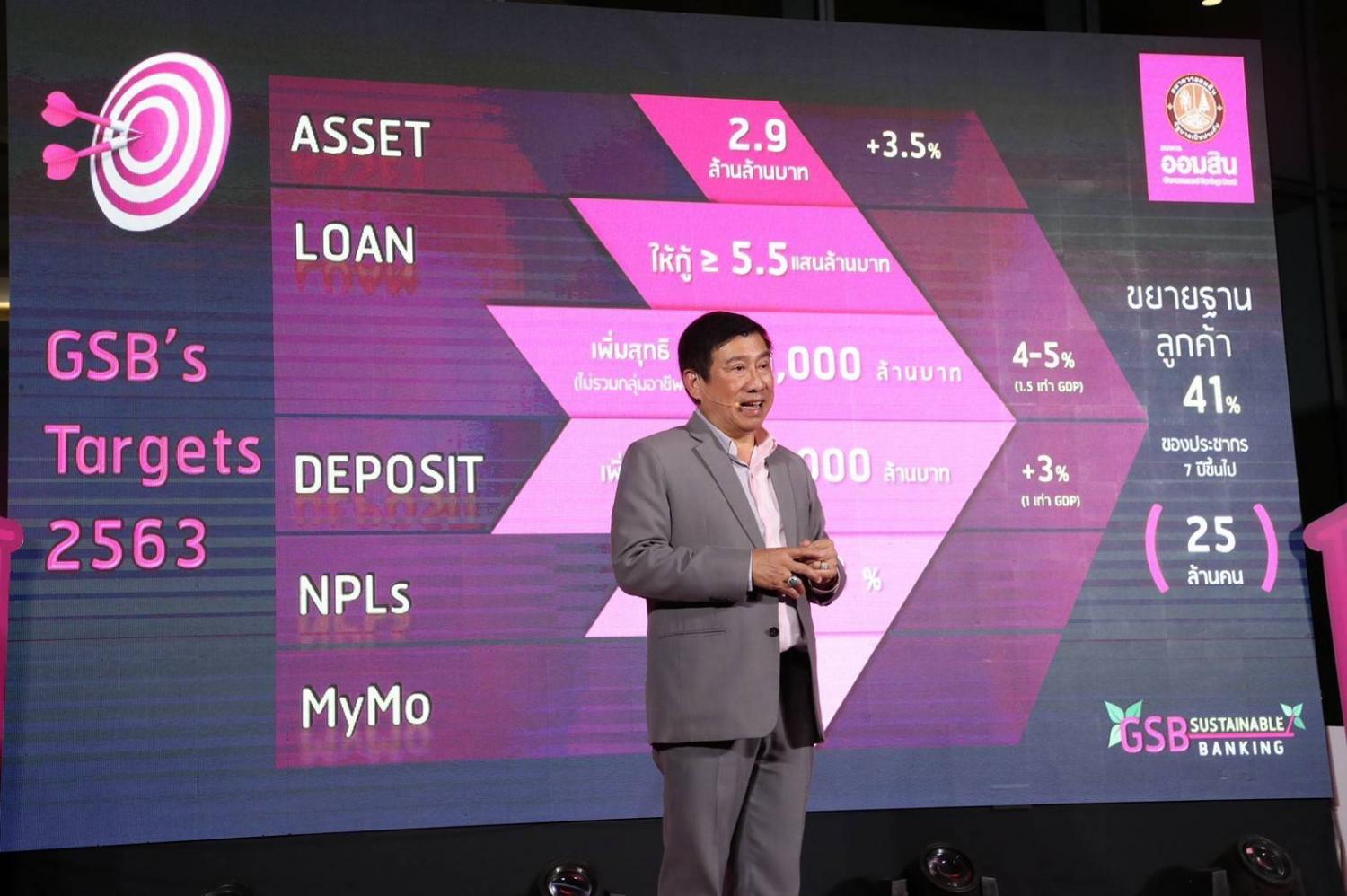

GSB sets higher bar for 2020 lending

Business, Wichit Chantanusornsiri, Published on 16/01/2020

» State-owned Government Savings Bank (GSB) aims to extend loans worth 550 billion baht and raise the customer base to cover 41% of the country's population this year.

GSB upbeat on loan growth goal

Business, Wichit Chantanusornsiri, Published on 29/06/2019

» State-owned Government Savings Bank (GSB) is confident of achieving its full-year lending growth target of 5-6%, given that the new government's formation and expected stimulus measures will help boost loan demand in the second half.

GSB clients clear of rate hike

Business, Wichit Chantanusornsiri, Published on 21/12/2018

» Most of Government Savings Bank's retail customers will be unaffected by the central bank's rate hike because their rates are fixed, says the head of GSB.

KTB offers logistics card for taxes, fee payment

Business, Wichit Chantanusornsiri, Published on 13/12/2018

» Krungthai Bank (KTB) aims for 30% of 6,000 shippers nationwide to use its newly launched cards for electronic payments by the middle of next year, its chief says.