Showing 1 - 10 of 10,000

Plan to tax gold imports stokes Thai industry criticism

Published on 23/02/2026

» Gold traders strongly oppose the Customs Department’s plan to ask the incoming government to impose import duties on gold, warning that Thailand could lose its status as a gold trading hub if the measure is implemented. They added that gold is now regarded as an investment asset rather than a commodity subject to tariffs.

ETRO Residences Phuket Breaks Island Price Record with Landmark Luxury Debut

Published on 23/02/2026

» PHUKET, Thailand — ETRO Residences Phuket has set a new benchmark for luxury real estate after achieving the highest residential price ever recorded on the island just days after launch.

IRPC accelerates 4R strategy: “Recapitalise, Revitalise, Reframe, Reinvent”

Published on 23/02/2026

» IRPC Public Company Limited (IRPC) led by Terdkiat Prommool, President and Chief Executive Officer announced:

Bitcoin falls below $65,000

Bloomberg News, Published on 23/02/2026

» Bitcoin slid below US$65,000 in early Asia trading on Monday, roiled by fresh nervousness over the status of US tariffs.

Geopolitics, Volatility, and the Case for a Strong Trading Fortress

Published on 23/02/2026

» In a world connected at the speed of a fingertip, a troop movement on the other side of the globe or the signing of a trade agreement by major powers is no longer just foreign news buried in a newspaper column. It has become a trading signal, one that can impact your investment portfolio within seconds.

Airports of Thailand must justify charge

Oped, Editorial, Published on 23/02/2026

» The decision by Airports of Thailand (AoT) to raise the international Passenger Service Charge (PSC) from 730 baht to 1,120 baht marks the steepest increase in nearly two decades.

Revolutionising the Foundations for Corporate Infrastructure Transformation

Published on 23/02/2026

» A Team of Experts Who Transform System Chaos into Strategic Assets The True FUJIFILM Business Innovation [Part One]

Trump’s threatened strikes to force an Iran deal risk backfiring

Published on 22/02/2026

» NEW YORK -- President Donald Trump said he is considering limited military strikes to pressure Iran into signing a new nuclear deal, but bombing the country may have the opposite effect, risking a new destabilizing conflict in the Middle East.

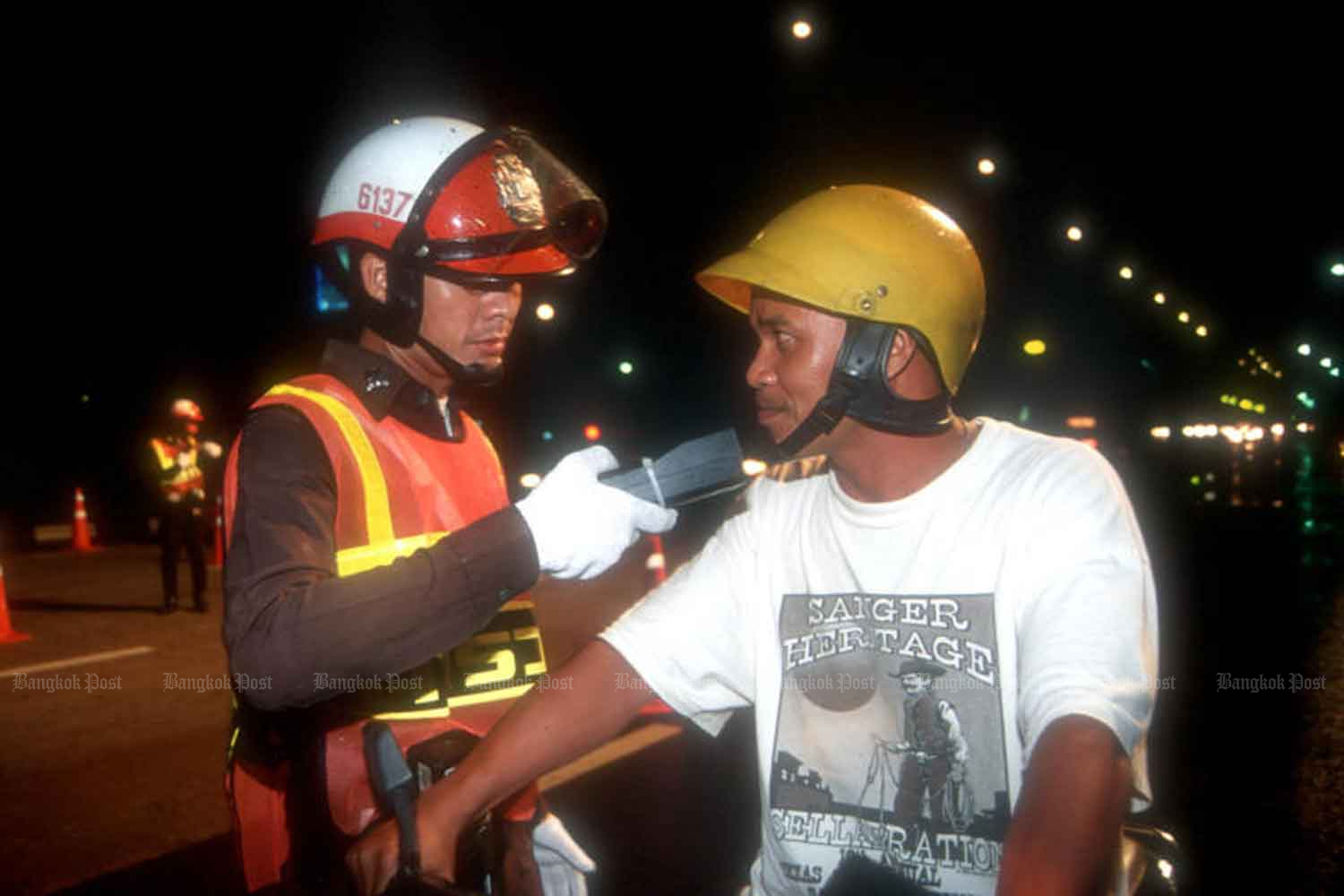

Breath test refusal equals drink-driving

News, Post Reporters, Published on 22/02/2026

» Police have warned that a refusal to take a breathalyser test will be treated as equivalent to drink-driving.

Post-poll power plays face danger

Aekarach Sattaburuth, Published on 22/02/2026

» More than two weeks after the Feb 8 general election, the political landscape remains clouded by legal uncertainty and high-stakes coalition bargaining.