Showing 1 - 10 of 10,000

Trump’s threatened strikes to force an Iran deal risk backfiring

Published on 22/02/2026

» NEW YORK -- President Donald Trump said he is considering limited military strikes to pressure Iran into signing a new nuclear deal, but bombing the country may have the opposite effect, risking a new destabilizing conflict in the Middle East.

Andrew's arrest just King Charles' latest royal crisis

AFP, Published on 22/02/2026

» LONDON - King Charles III has been left wrestling with a new test after the arrest of his brother Andrew, the latest in a series of painful personal shocks to mar his reign.

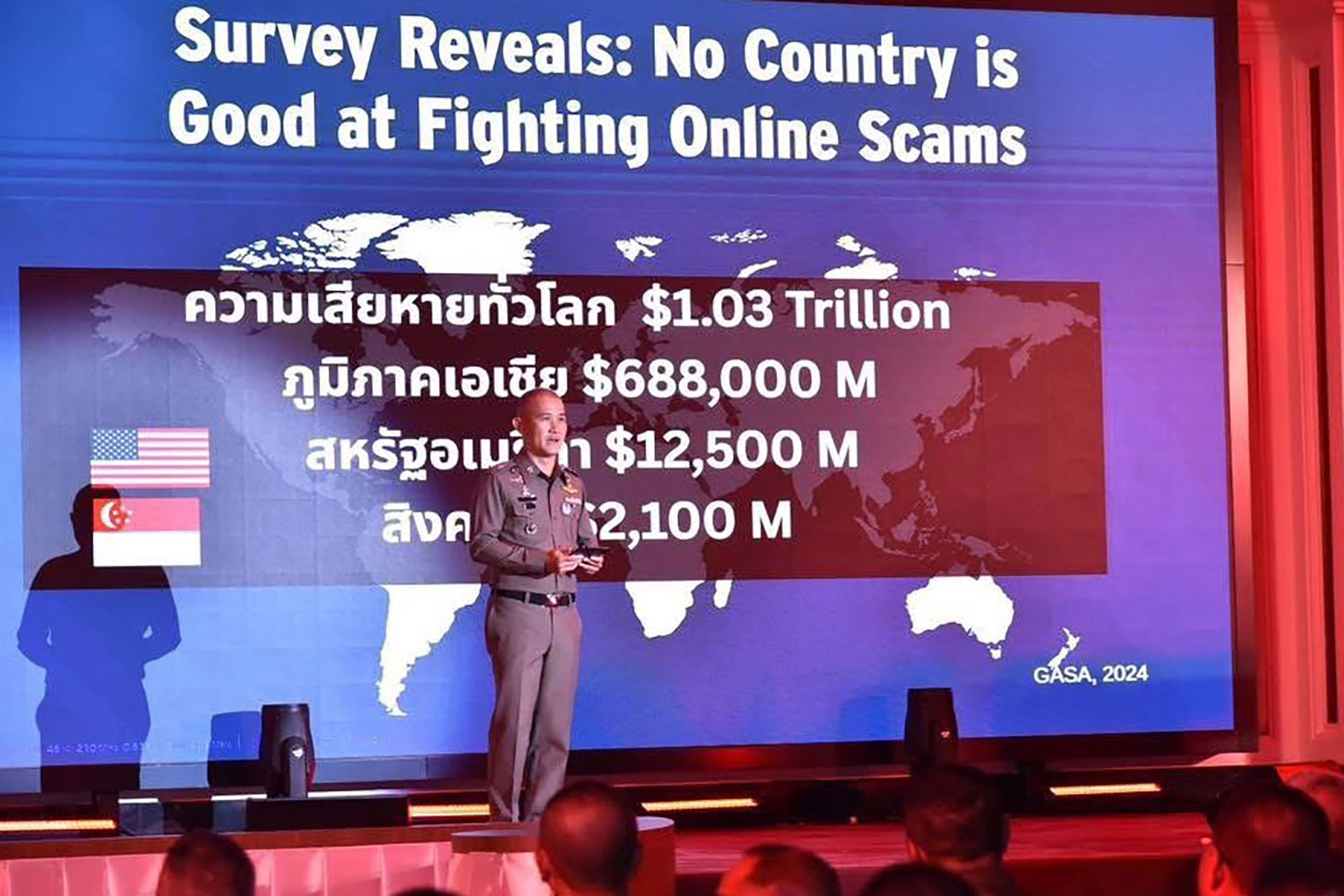

Retiree duped out of B24m in ‘high-yield’ investment scam

Wassayos Ngamkham, Published on 22/02/2026

» A 75-year-old retired civil servant lost almost 24 million baht to an online investment scam that hijacked the name of a popular restaurant brand and used the Line messaging app to attract victims.

Summer storms warning for northern Thailand

Online Reporters, Published on 22/02/2026

» The Meteorological Department has issued its second advisory on summer storms, warning that severe weather is expected across northern Thailand from Monday through into Wednesday.

The moggy that rules Downing Street

Roger Crutchley, Published on 22/02/2026

» Important news from London. This past week Larry the Cat has been celebrating his 15th year as chief mouser at 10 Downing Street. During that time the tabby has served six different prime ministers and has arguably been considerably more popular than any of them.

Ukraine rebuttal

Postbag, Published on 22/02/2026

» Re: "Ignored security concerns fuel Ukraine conflict", (Opinion, Feb 21).

A new look at history education

Editorial, Published on 22/02/2026

» As the Election Commission has yet to endorse the outcome of the national election, the caretaking and presumptive Prime Minister Anutin Charnvirakul is actively presenting his vision and policies. His latest proposal involves revamping the teaching of national history.

Post-poll power plays face danger

Aekarach Sattaburuth, Published on 22/02/2026

» More than two weeks after the Feb 8 general election, the political landscape remains clouded by legal uncertainty and high-stakes coalition bargaining.

Chelsea, Aston Villa held in blow to Champions League hopes

AFP, Published on 22/02/2026

» LONDON - Burnley dented Chelsea's chances of Champions League qualification by snatching a 1-1 draw at Stamford Bridge, while Aston Villa also struck late to salvage a point against Leeds on Saturday.

Mendez brace gives Prachuap crucial victory

Sports, Tor Chittinand, Published on 22/02/2026

» Edgar Mendez struck twice as PT Prachuap secured a 2-0 victory over Rayong in Thai League 1 on Friday night at Sam Aoh Stadium.