Showing 1 - 10 of 4,086

Mongolian art on show at 'Wolf Loving Princess'

Life, Published on 23/02/2026

» Art lovers are invited to experience the poetic and speculative world of a Mongolian artist during "Wolf Loving Princess", which is running at Gallery Ver until April 25.

Thailand to raise international passenger fee in June

Online Reporters, Published on 20/02/2026

» Airports of Thailand (AOT) announced on Friday that the passenger service charge (PSC) on outbound international travellers will rise to 1,120 baht per person from 730 baht from June 20, 2026.

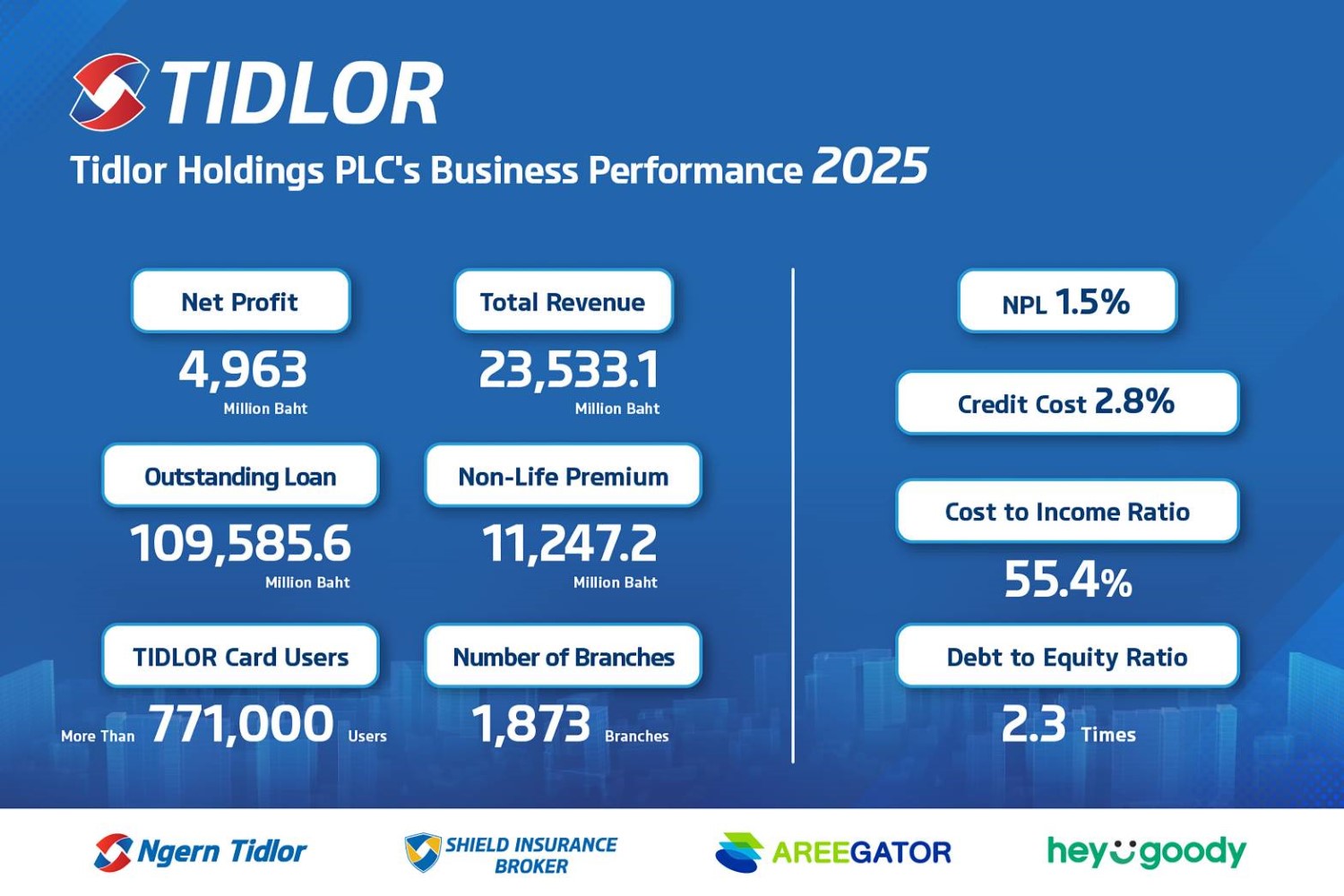

TIDLOR Posts Record 2025 Profit of 4.96bn baht, NPL Falls to 1.5%

Published on 20/02/2026

» Feb 20, 2026 – Tidlor Holdings Public Company Limited (“TIDLOR” or the “Group”) announced its 2025 operating results, reporting a record net profit of 4,963 million baht, up 17.4% year-on-year.

Art, music, browsing lands at Dadfa

Life, Published on 19/02/2026

» A lineup of artists will bring their unique creations to life at "Happening Open Yard" in Dadfa Market Park, Lasalle 33, Sukhumvit 105, on Saturday from 11am to 7pm.

New project to help riders switch to EVs

News, Supoj Wancharoen, Published on 17/02/2026

» The Bangkok Metropolitan Administration (BMA) has partnered with the German Society for International Cooperation (GIZ) on a project to support motorcycle taxi riders in switching to electric vehicles.

BMA opens car park for public use

News, Post Reporters, Published on 17/02/2026

» Visitors can now park their cars at Bangkok Metropolitan Administration's (BMA) public parking lot under Lan Khon Muang (City Square) outside City Hall's operating hours, says Bangkok governor Chadchart Sittipunt.

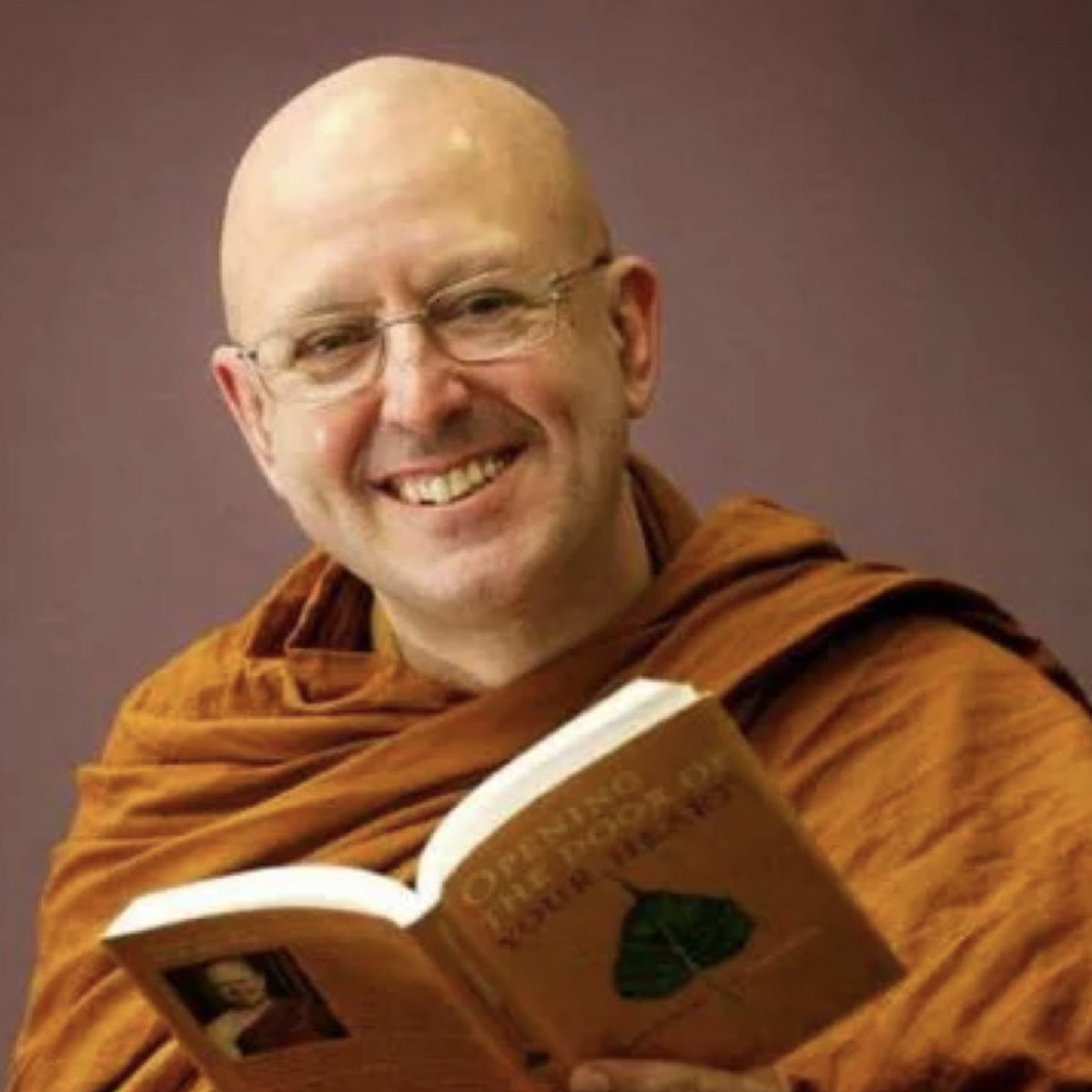

Ajahn Brahm to conduct dhamma talk this Sunday

Life, Published on 17/02/2026

» Ajahn Brahm, abbot of Bodhinyana monastery in Western Australia, will deliver a dhamma talk on the theme "Selflessness Creates The Path To Peace", at the World Fellowship of Buddhists on Sunday from 3pm to 5pm.

How to give your résumé a 2026 makeover

Business, Published on 17/02/2026

» You are wrong if you think your CV/résumé is intended to get you a job. It's not.

Online storm over Phuket ceramics shop's B40 entry fee

Achadthaya Chuenniran, Published on 16/02/2026

» PHUKET - The owner of a ceramics shop at the centre of an online drama after charging Chinese tourists a 40 baht entry fee had properly displayed the details of the service charge, which was legal, the Phuket Provincial Commercial Office said on Monday.

MINT Posts 21% Core Profit Growth in 4Q25, 16% for FY2025

Published on 16/02/2026

» Bangkok, Thailand – Minor International Public Company Limited (MINT) has delivered another quarter of strong, high-quality earnings, with core profit rising 21% to THB 3.472 billion in 4Q25 and 16% y-y to THB 9.700 billion for FY2025, reflecting the strength of MINT’s diversified global platform and disciplined execution.