Showing 1 - 10 of 10,000

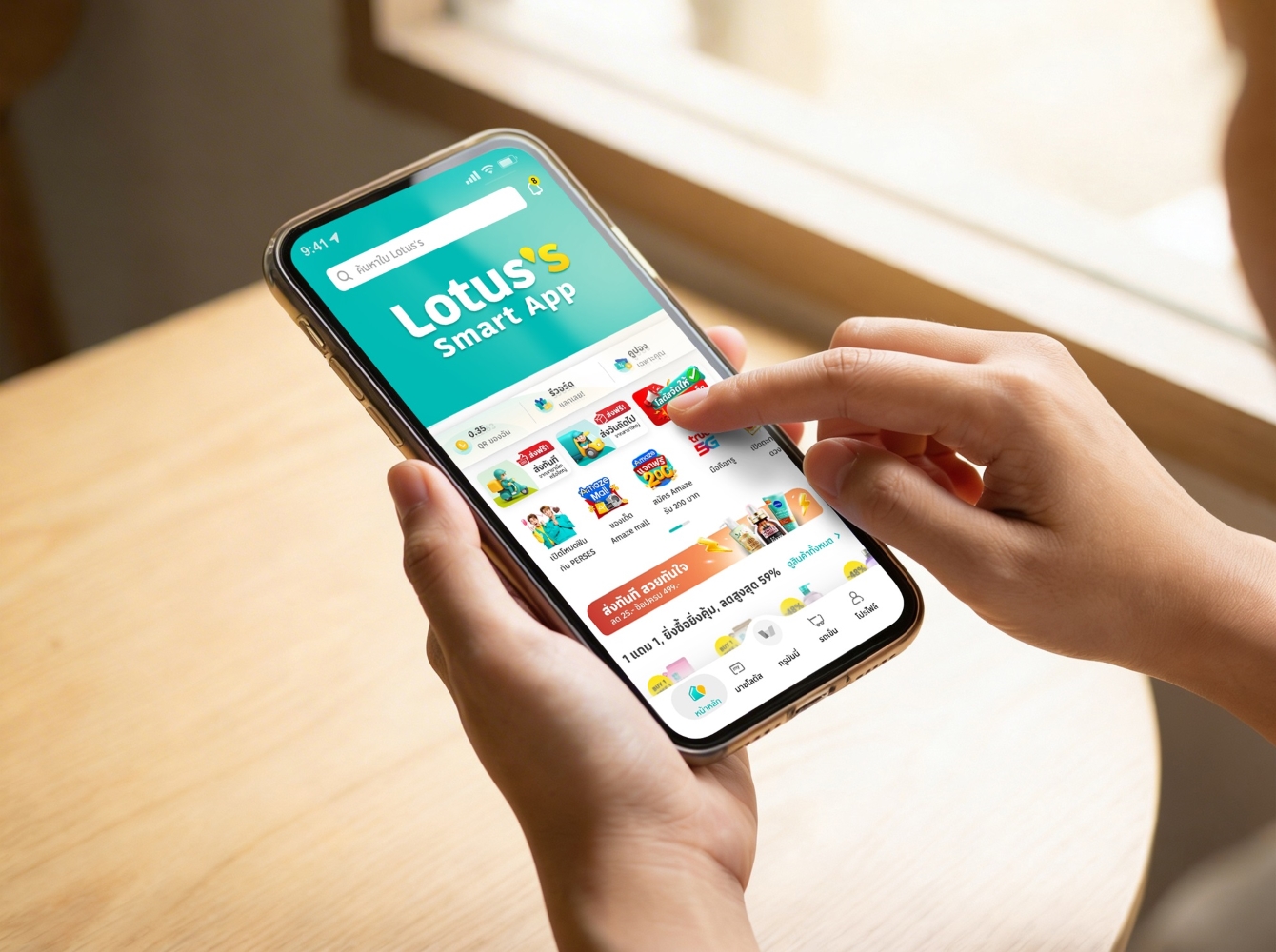

Lotus’s Hits 30M Online Orders in 2025 Across All Channels

Published on 27/02/2026

» · In 2025, Lotus’s recorded a total of 30 million online orders across all channels, with 21 million orders via the Lotus’s Smart App, reinforcing its leadership as Thailand’s Leading Grocery On-Demand platform.

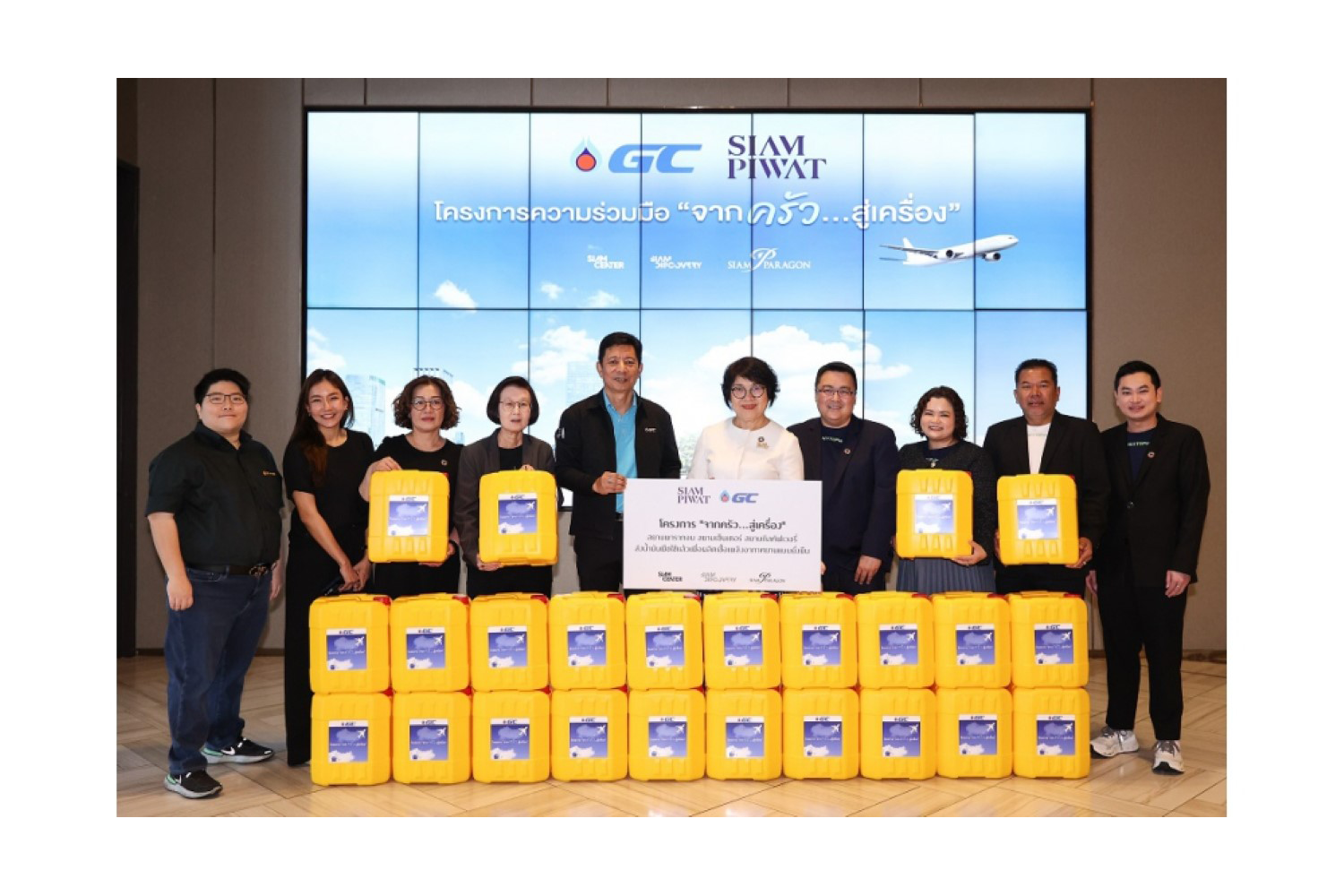

GC joins forces with Siam Piwat to scale up “From Kitchen to Creation”

Published on 27/02/2026

» PTT Global Chemical Public Company Limited (GC), a global leader in chemicals and Thailand’s first commercial producer of sustainable aviation fuel (SAF), has announced a partnership with Siam Piwat Group to expand the “From Kitchen to Creation” project. Under this initiative, used cooking oil (UCO) from restaurants within Siam Paragon will be collected and sent to GC’s biorefinery to be processed into clean energy and high-value bio-products, making Siam Paragon the first shopping mall in Thailand to join the programme.

Guru's Weekly Buzz: Feb 27-Mar 5

Guru, Published on 27/02/2026

» Guru By Bangkok Post's weekly pick of the most exciting products, activities, food and travel to indulge in.

Your horoscope for Feb 27 - Mar 5

Guru, Chaiyospol Hemwijit, Published on 27/02/2026

» Your spot-on horoscope for work, money and relationship from Guru by the Bangkok Post's famously accurate fortune teller. Let's see how you will fare this week and beyond.

Ariya stays in hunt after a solid 69 in Singapore

Sports, Published on 27/02/2026

» Singapore: Thailand's Ariya Jutanugarn shot a three-under-par 69 to trail leader Auston Kim of the United States by three strokes after the first round of the Women's World Championship at Sentosa Golf Club (Tanjong Course) in Singapore yesterday.

Portugal calls for global unity, multilateralism

Oped, Published on 27/02/2026

» It is a great pleasure to be here in Thailand, and especially good to be able to have this opportunity to share our vision on how Portugal views the world and the role and importance of multilateralism.

E-commerce giants form Thai trade group

Published on 26/02/2026

» Thailand needs a sustainable digital infrastructure to guarantee continued health of the industry, according to the Thai Digital Platform Trade Association (TDPA), a new trade group founded by major operators Grab, Lazada, Line Man Wongnai and Shopee.

Bayer inaugurates Khon Kaen Vegetable Seeds Production Centre as Asia Hub, strengthening regional and global supply

Published on 26/02/2026

» - New Khon Kaen Centre commenced operations in January 2026, consolidating existing local sites and enhancing export-grade capacity for APAC and global markets.

US eases Cuba oil embargo but demands 'dramatic' change

AFP, Published on 26/02/2026

» BASSETERRE (SAINT KITTS AND NEVIS) - The United States on Wednesday eased an oil embargo on Cuba but Secretary of State Marco Rubio said the communist-run island must change "dramatically," saying it had only itself to blame for an economic crisis.

Real Madrid victory for 'everyone against racism': Tchouameni

AFP, Published on 26/02/2026

» MADRID - Real Madrid midfielder Aurelien Tchouameni said his team's 2-1 win against Benfica on Wednesday to reach the Champions League last 16 was a victory for "everyone who is against racism".