Showing 1 - 10 of 6,554

BoT upgrades Thai GDP forecast after robust Q4

Business, Somruedi Banchongduang, Published on 25/02/2026

» The Bank of Thailand is upbeat about the country's growth prospects, projecting GDP expansion of 1.9% this year, up from its previous estimate of 1.5%, after the economy grew stronger than forecast in the fourth quarter of last year.

Police warn over stray pet conflicts

News, Post Reporters, Published on 25/02/2026

» The Royal Thai Police (RTP) have raised concerns about escalating conflicts between neighbours caused by dogs and cats allowed to roam free, warning pet owners to take greater responsibility or face legal consequences.

Bualuang Securities flags politics as primary market risk

Business, Nuntawun Polkuamdee, Published on 25/02/2026

» Domestic political uncertainty is the Thai stock market's most significant immediate risk, as it could undermine investor confidence in the short term if left unresolved, while US tariff measures are viewed as a secondary external headwind, says Bualuang Securities (BLS).

AI will transform business, not just our jobs

Oped, Published on 25/02/2026

» Many people fear that AI could cause a "job-pocalypse". This year's Davos gathering sounded the alarm over the technology's implications for employment, while recent announcements about job cuts in white-collar industries are widely viewed as straws in the wind.

Demographics fuel Bangkok Life Assurance's growth drive

Business, Nuntawun Polkuamdee, Published on 25/02/2026

» Bangkok Life Assurance (BLA) expects Thailand's life insurance industry to maintain its growth momentum this year, supported by demographic tailwinds and regulatory flexibility, as the company prepares to increase its exposure to Thai equities and roll out a new long-term care product targeting age-related diseases.

BDMS Ranks in DJSI World’s Top 1% for Third Consecutive Year

Published on 24/02/2026

» Bangkok / February 24 – Bangkok Dusit Medical Services Public Company Limited (BDMS) has been ranked among the Top 1% in the Dow Jones Sustainability Indices (DJSI 2025) in the Health Care Providers & Services sector for the third consecutive year, and in the DJSI Emerging Markets for the fifth consecutive year. The rankings are based on the 2025 sustainability assessment of leading companies worldwide.

CP AXTRA 2025: Revenue 520.7 Billion Baht, Online +27.4%, Dividend 0.71 Baht/share

Published on 24/02/2026

» Bangkok: February 23, 2026 – CP AXTRA Public Company Limited (The Company or CPAXT), the operator of Asia's leading wholesaler and retailer "Makro and Lotus's", announced its 2025 operating results, reporting total revenue of 520,706 million baht and net profit of 9,356 million baht. The Company’s performance was driven by the following factors:

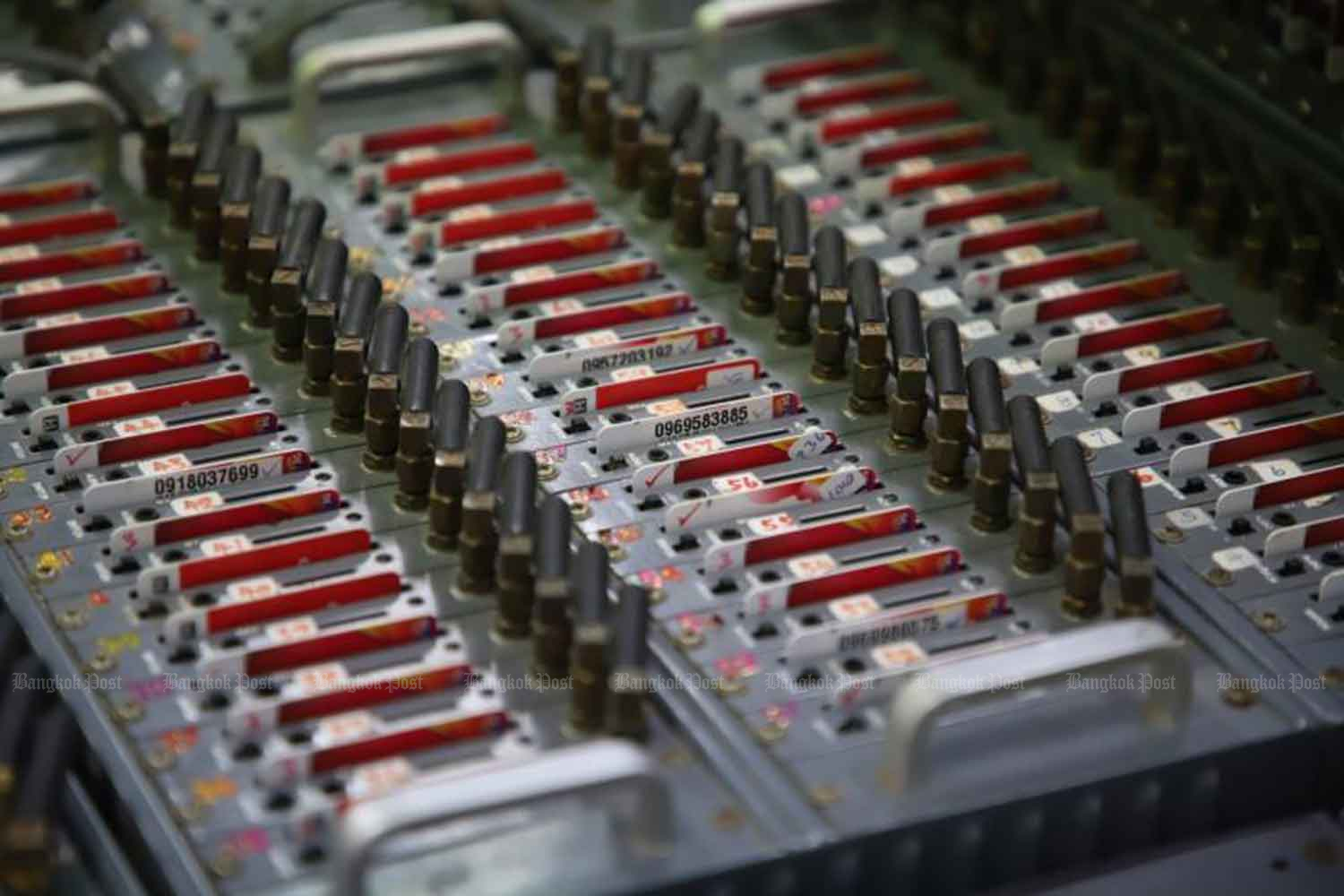

Fraud complaints 'declining'

News, Wassayos Ngamkham, Published on 24/02/2026

» The Anti Cyber Scam Centre (ACSC) has reported a decline in overall online fraud cases in the latest weekly review but warned that investment scams have surged to become the leading cause of financial losses, with damages exceeding 123 million baht.

Aberdeen bullish on local equities post-election

Business, Nuntawun Polkuamdee, Published on 24/02/2026

» Aberdeen Asset Management has adopted a bullish stance on Thai equities following the recent election, noting political clarity and improving stability could pave the way for renewed foreign inflows and a recovery in the benchmark index to 1,500 points.

IRPC accelerates 4R strategy: “Recapitalise, Revitalise, Reframe, Reinvent”

Published on 23/02/2026

» IRPC Public Company Limited (IRPC) led by Terdkiat Prommool, President and Chief Executive Officer announced: