Showing 61 - 70 of 10,000

Tariff turmoil fails to rattle WHA's expansion blueprint

Business, Ranjana Wangvipula, Published on 27/02/2026

» US President Donald Trump's new 15% tariff policy does not pose a new business challenge to WHA Corporation, which is now prepared to navigate the economic uncertainty continuously fuelled by the world's largest economy.

US AI boom faces electric shock

News, Published on 27/02/2026

» Big Tech's race to dominate artificial intelligence may soon hit a nasty road bump, at least in the US, where electricity grids struggle to keep pace with the big-spending hyperscalers.

E-commerce giants form Thai trade group

Published on 26/02/2026

» Thailand needs a sustainable digital infrastructure to guarantee continued health of the industry, according to the Thai Digital Platform Trade Association (TDPA), a new trade group founded by major operators Grab, Lazada, Line Man Wongnai and Shopee.

CMAN posts second straight record profit despite revenue dip

Published on 26/02/2026

» Chememan Public Company Limited (CMAN), a leading global producer of lime and lime derivatives under the CHEMEMAN brand, posted a record net profit for the second consecutive year in 2025, despite a decline in revenue amid lower selling prices and currency headwinds.

Energy Absolute: Top Global Sustainability Leader for 5th Year with DJSI Score of 83

Published on 26/02/2026

» Bangkok — Energy Absolute Public Company Limited (EA), a Thailand-based renewable energy and electric mobility company, announced its continued success on the global stage by retaining its status in the Dow Jones Best-in-Class Indices for the fifth consecutive year in the Electric Utilities sector.

“heygoody.com” wins special award for digital native business

Published on 26/02/2026

» heygoody.com, the digital insurance brokerage platform by Ngern Tid Lor PLC, a subsidiary of Tidlor Holdings (TIDLOR), has won the Special Award for Digital Native Business at the IDC Future Enterprise Awards. The competition is hosted by International Data Corporation (IDC), a leading global provider of market intelligence, advisory services and events for the information technology (IT), telecommunications and consumer technology markets, headquartered in Singapore.

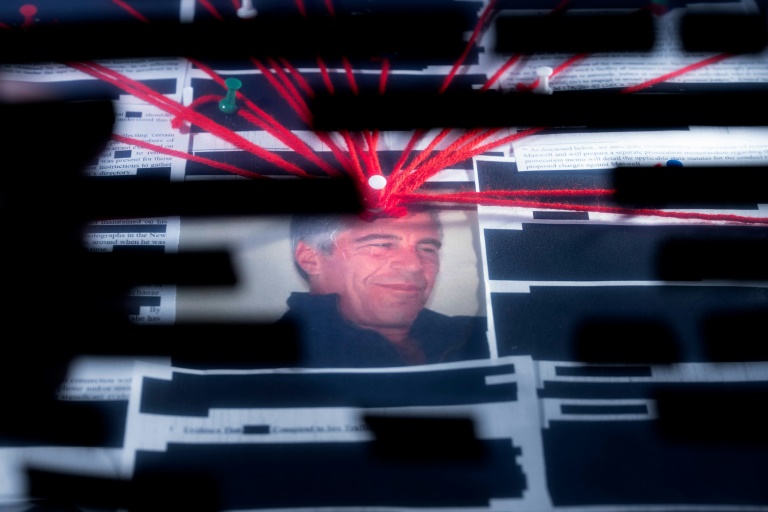

Epstein files reveal links to cash, women, power in Africa

AFP, Published on 26/02/2026

» PARIS - Jeffrey Epstein built close ties with powerful figures in Senegal and Ivory Coast, files released by the US government last month show, detailing the late sex offender’s influence network across Africa.

Imprisoned Hong Kong tycoon Jimmy Lai wins rare appeal

Published on 26/02/2026

» A Hong Kong court has overturned former media mogul Jimmy Lai’s conviction in a fraud case, in a rare win for the pro-democracy advocate serving a 20-year sentence for national security charges.

Iconsiam: Best Brand on Social Media (Shopping Center) at 14th Thailand Social Awards.

Published on 26/02/2026

» Iconsiam, a global landmark on the banks of the Chao Phraya River, has solidified its leadership in digital content and online communication by winning Best Brand Performance on Social Media in the Shopping Center & Department Store category at the 14th Thailand Social Awards. The achievement reflects its capability to produce outstanding, comprehensive content that effectively connects the brand with consumers across all social media platforms. Over the past year, its major campaigns and content, aligned with digital-era consumer behaviour, generated phenomenal reach, reinforcing its role as a Global Experiential Destination that is not only a world-class lifestyle and tourism destination but also a powerful online community builder.

Homes for hornbills: A masterplan for nature

Published on 26/02/2026

» For centuries, Thailand’s ecosystems have relied on natural cycles driven by once-abundant wildlife, including hornbills. These small forces of nature have grown even smaller, with only 13 hornbill species remaining in Thailand to perform their vital role as seed dispersers that enable forest regeneration.