Showing 741 - 750 of 10,000

IRPC Wins Outstanding Innovative Company Award

Published on 04/12/2025

» IRPC Public Company Limited has been recognised for its breakthrough innovation at the SET Awards 2025, reinforcing the company’s leadership in high value-added solutions and sustainable industrial development.

Thai airport tax to rise 53% for international flights

Supoj Wancharoen, Published on 04/12/2025

» The Civil Aviation Board has approved a 53% increase in the passenger service charge, commonly known as the airport tax, for outbound passengers on international flights.

Meta starts removing under-16s from social media in Australia

AFP, Published on 04/12/2025

» SYDNEY - Tech giant Meta said on Thursday it is starting to remove under-16s in Australia from Instagram, Threads and Facebook ahead of the country's world-first youth social media ban.

Hyundai beefs up BEV sector

Business, Lamonphet Apisitniran, Published on 04/12/2025

» Thailand's battery electric vehicle (BEV) industry is predicted to accelerate in 2026, with Hyundai Mobility Thailand preparing to roll out locally assembled BEVs as the nation strives to become a regional export hub.

Luxury demand strong in western Bangkok

Business, Kanana Katharangsiporn, Published on 04/12/2025

» Western Bangkok is regaining momentum with new housing launches in two key price segments, 55-120 million baht and 9-12 million baht, led by major developers Sansiri and Supalai, despite an overall slowdown in the single detached housing market.

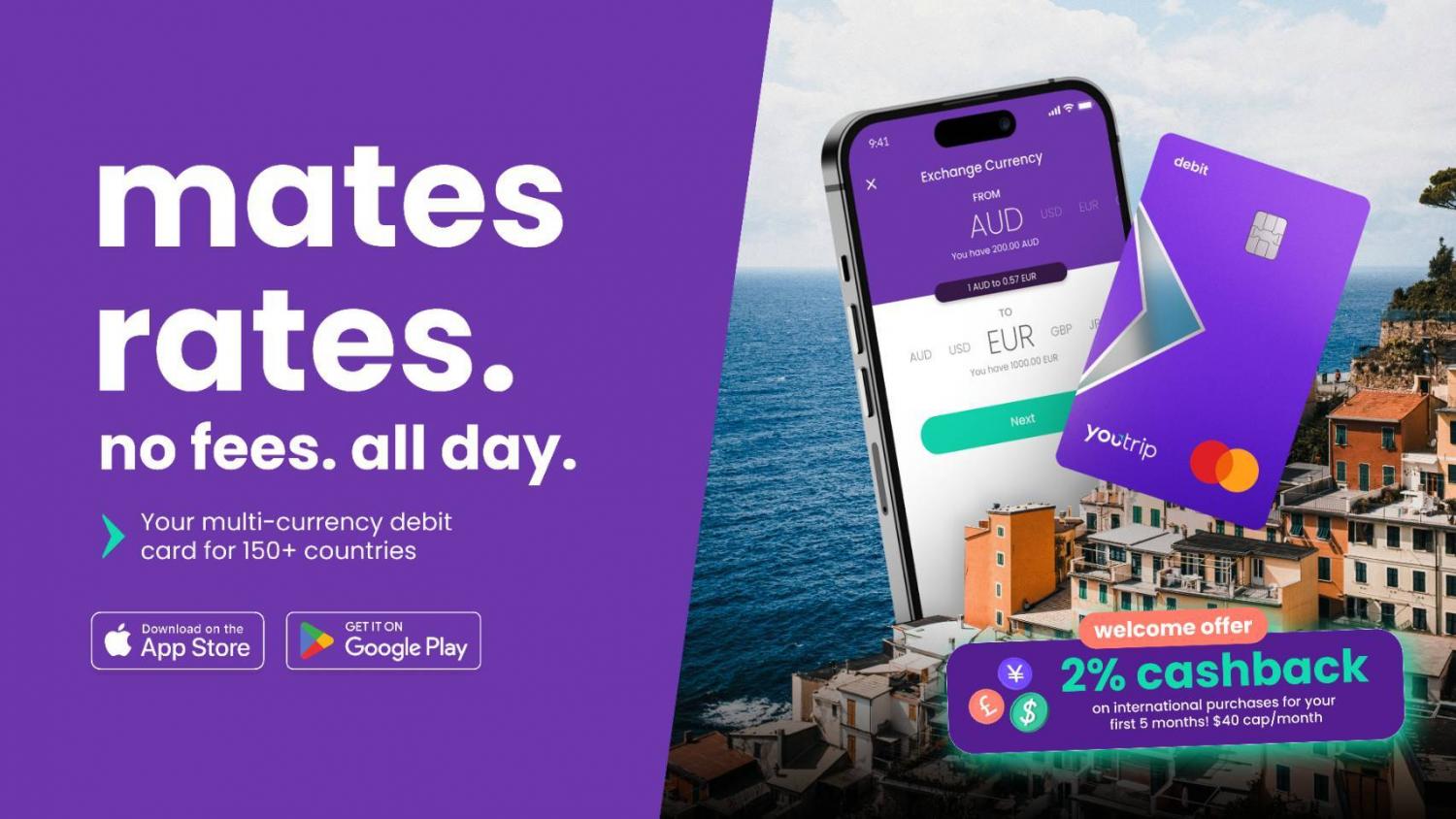

YouTrip targets 10% growth a year

Business, Somruedi Banchongduang, Published on 04/12/2025

» YouTrip, Asia-Pacific's leading multi-currency travel card, expects to maintain annual growth of 10% over the next three years and is preparing to list on a US stock exchange during that period.

Moshi Moshi upbeat on lifestyle shopping

Business, Kuakul Mornkum, Published on 04/12/2025

» Although the economy in 2026 is expected to be challenging, the lifestyle retail market is still expected to grow, according to Moshi Moshi Retail Corporation Plc.

Generali Thailand Launches Global “HERE. NOW.” Campaign

Published on 03/12/2025

» Generali Thailand is strengthening its position as a world-class insurance brand with the launch of its new global campaign, “Generali – Here. Now.” This strategic initiative from Generali Group communicates the belief that “the future’s built in the present,” reflecting the company’s commitment as a Lifetime Partner 27: Driving Excellence standing alongside customers in every meaningful moment of their lives. The campaign will roll out across multiple platforms, including digital media, out-of-home advertising, and a fleet of electric tuk-tuks, enhancing public awareness and reinforcing the essence of “being there in every moment that matters.”

Spreading the holiday cheer

Guru, Nianne-Lynn Hendricks, Published on 03/12/2025

» Guru By Bangkok Post has put together a selection of festive offers throughout Thailand that will put you in the spirit of the holidays and welcome the new year in style as you eat, drink and celebrate your way into 2025. This is part two.

Ricoh Thailand Transforms into Digital Services Provider

Published on 03/12/2025

» Ricoh (Thailand) Ltd. has announced its strategic transformation into a full-scale Digital Services Provider at the Imagine Change 2025 – Cloud & AI Press Conference, held at the Four Seasons Hotel Bangkok. The company showcased breakthrough cloud and AI solutions designed to enhance workflow efficiency and data-driven decision-making for Thai organisations advancing into the next phase of digital modernisation.