Showing 1 - 10 of 13

Tax issues and business transfers: the devil is in the details

Business, Lawalliance Limited Company, Published on 25/07/2017

» Ever since tax incentives for business reorganisation were introduced two decades ago, different issues have arisen intermittently, especially as they relate to an entire business transfer (EBT), which has become a popular practice.

Understanding the tax liabilities of partners in an unincorporated joint venture

Business, Lawalliance Limited Company, Published on 27/06/2017

» In doing business via a joint venture, knowing the tax implications could help you avoid potentially perilous situations. This includes understanding corporate laws that may affect the tax liabilities of the partners.

Missed a tax refund deadline? Don't lose hope

Business, Lawalliance Limited Company, Published on 10/01/2017

» Every provision in every piece of legislation has its own reason for being, and any act that contradicts the spirit of the law, even if carried out by a government body, is generally disallowed if it deprives a person of his or her rights. This principle is also applied in considering the time limit for a taxpayer to claim a tax refund.

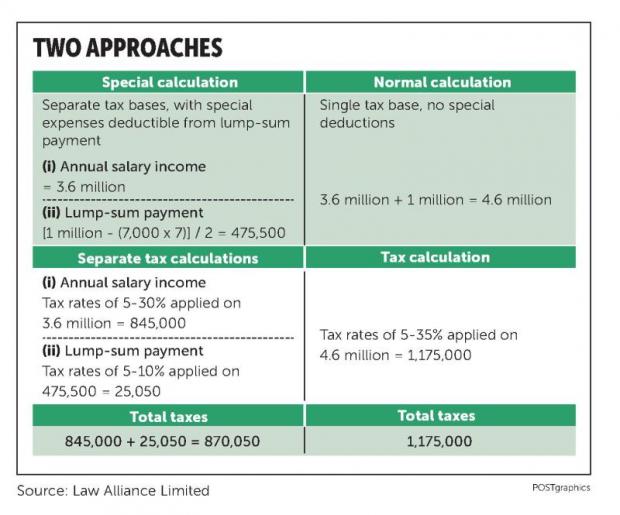

Lump-sum payments to departing employees

Business, Lawalliance Limited Company, Published on 12/07/2016

» When employment comes to an end, whether due to retirement, redundancy or voluntary resignation, the employer may need to make a lump-sum payment to the employee. As the lump sum could be all that a retired employee has left to live on, or a fund to be used during the vocational transition, the law helps to ease the tax burden by allowing a special calculation so that it is taxed separately from other income.

When will a liquidator be released from tax liability?

Business, Lawalliance Limited Company, Published on 26/01/2016

» When a life ends, whether that of a person or a business, it does not mean tax liability will also end. Dissolution and liquidation of a company are part of many corporate reorganisations, and in our experience this often requires the liquidator to make a speedy distribution of cash and other assets to shareholders. Thus, it is necessary for the liquidator to understand what he has got himself into.

Making a tax appeal under new procedures

Business, Lawalliance Limited Company, Published on 17/11/2015

» In our previous article, we took a big-picture look at the forthcoming changes in tax appeal procedures at the court level. One of the main changes is an appeal against a judgement by the Central Tax Court must be made to the new Special Court of Appeal, and its judgement will be treated as final. Only in some exceptional cases will the litigant be able to appeal to the Supreme Court, which must grant permission for the filing first.

New era for tax appeals in the offing

Business, Lawalliance Limited Company, Published on 03/11/2015

» It is commonly known that tax disputes can take years to resolve, with the longest delays usually seen at the Supreme Court level. From the date a complaint is submitted to the Tax Court until the final judgement is rendered by the Supreme Court, it could take four to seven years.

VAT complications for transport services

Business, Lawalliance Limited Company, Published on 08/09/2015

» Because transport forms a part of many business activities, much confusion can arise when calculating tax for a transaction that includes transport along with the sale of goods or provision of services.

Unusually rich? Then be prepared for a 'special' audit

Business, Lawalliance Limited Company, Published on 21/04/2015

» It's not a story that has attracted much attention, but the Revenue Department is being urged to start taking tax evasion by corrupt politicians much more seriously. The goal is to not only improve below-target tax collections but also prevent such politicians from using their ill-gotten gains to finance their next election campaigns.

Clearing up confusion over joint bank accounts

Business, Lawalliance Limited Company, Published on 07/04/2015

» The introduction of a new tax regime for unregistered partnerships this year has created a lot of anxiety for a lot of people. New legislation repealed an old rule that made it too easy for individuals to create separate taxable entities to reduce personal income tax liability.