Showing 1 - 7 of 7

OIC: Car coverage continues to evolve

Business, Darana Chudasri, Published on 22/09/2020

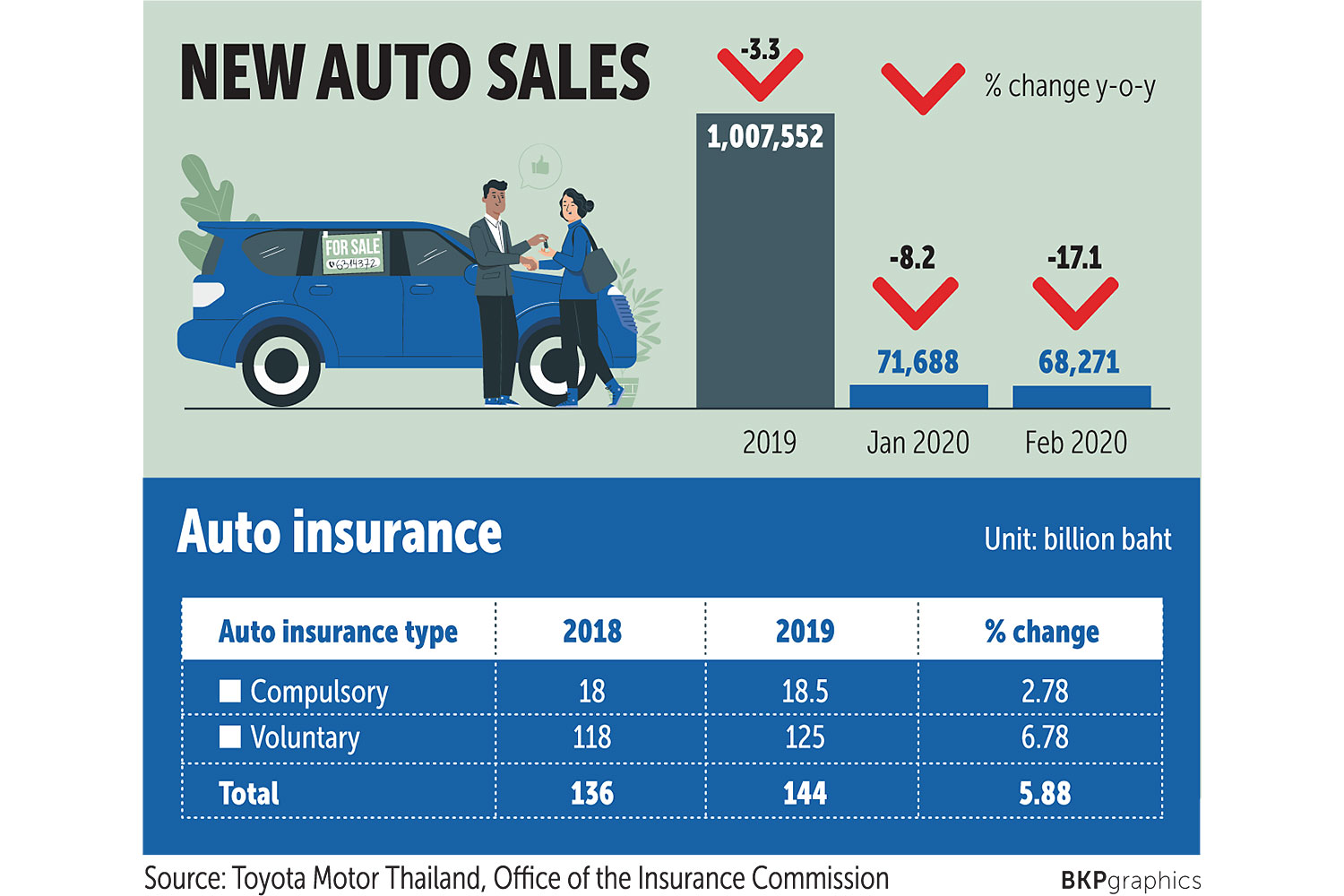

» Car insurers are adjusting their product strategies to focus on short-term payments and insurance based on actual use as the market is expected to rebound in the second half of the year.

OIC, DLT sign agreement on car insurance tracking

Business, Darana Chudasri, Published on 18/09/2020

» The Office of Insurance Commission (OIC) and the Department of Land Transport (DLT) will share real-time data on compulsory car insurance this year, aiming to reduce the number of uninsured vehicles on the road, especially motorcycles.

Experts approve of OIC policy

Business, Darana Chudasri, Published on 28/04/2020

» Industry experts recommend auto insurance policyholders exploit the Office of the Insurance Commission's (OIC) policy to allow insurers to temporarily charge premiums on a pro-rata basis by putting the insurance on hold while working from home to either receive cash back or extend the protection period.

OIC allows brief digital auto policies

Business, Darana Chudasri, Published on 24/04/2020

» The Office of the Insurance Commission (OIC) is poised to enable non-life insurers to offer digital auto insurance with coverage for less than a standard 12-month period as the public becomes more familiar with digital tools during the coronavirus crisis.

OIC poised to ease car premiums

Business, Darana Chudasri, Published on 27/03/2020

» The Office of the Insurance Commission (OIC) may relax auto insurance premium payments for low-income earners, joining government and financial institutions' relief measures for coronavirus-affected individuals.

Technology transforms coverage

Business, Darana Chudasri, Published on 02/04/2018

» Digital transformation is shaping the way insurance companies do business and changing consumer behaviour in buying insurance products, enabling insurers to compile information about driving habits to calculate risks and offer usage-based policies, which helps some car owners pay lower premiums if they can prove to be safe drivers or they drive less.

Muangthai scales new heights

Business, Darana Chudasri, Published on 13/08/2015

» SET-listed Muangthai Leasing Plc (MTLS) expects record-high operating results this year.