Showing 1 - 10 of 10,000

Asian countries scramble to secure fuel supplies

Published on 05/03/2026

» The impact of the war in the Middle East rippled further through global energy markets on Thursday, with Asian countries taking more measures to shore up supplies.

Nude sex workers chase non-paying customer in Pattaya

Amporn Sangkaew, Published on 05/03/2026

» PATTAYA - Two transgender women were seen running completely naked after a foreign tourist while swearing and demanding payment for their sexual services near Pattaya beach early Thursday morning.

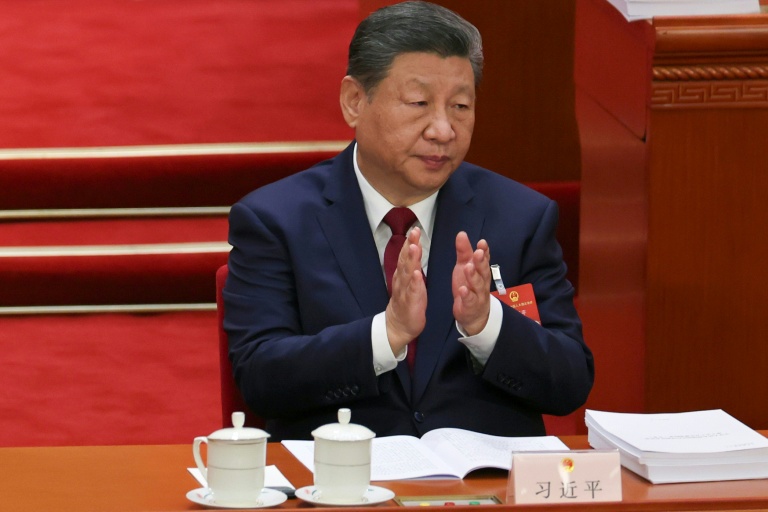

China sets lowest growth target in decades

AFP, Published on 05/03/2026

» BEIJING - China set its annual growth target at between 4.5% and 5% on Thursday, its lowest figure in decades but at the centre of plans to tackle sluggish consumption and a flagging property market.

Singapore to ban caged lorries for worker transport from 2027

Published on 05/03/2026

» Singapore will prohibit the use of caged lorries for transporting workers starting next year to mitigate safety risks during accidents or fires, Channel News Asia reported on Wednesday.

Mideast conflict a major roadblock for long-haul markets

Business, Molpasorn Shoowong, Published on 05/03/2026

» As the conflict in the Middle East weighs on global travel prices and travellers' pocketbooks, tourism operators project long-haul markets in 2026 will fall short of last year's 10 million arrivals.

Banpu consolidation drives clean energy transition

Business, Yuthana Praiwan, Published on 05/03/2026

» The merger of Banpu Power and its parent firm, Banpu Plc, an energy conglomerate, is expected to be completed by the first half of 2026, resulting in a new company that oversees four core businesses.

Risk of crisis growing more acute

News, Chartchai Parasuk, Published on 05/03/2026

» This article is a follow-up to my previous piece titled "Fiscal deficit will trigger 2026 crisis". In that article, I argued Thailand's heavy dependence on external liquidity, combined with the government's need for 860 billion baht annually to finance its deficits, would lead to a severe liquidity shortage and, ultimately, a financial crisis.

The future of audit: Governance safeguards quality and trust in AI era

Business, Published on 05/03/2026

» Auditing has long been the cornerstone of transparency and accountability in business. For much of its history, it has been a manual craft: imagine auditors working in conference rooms, sifting through piles of paperwork, and validating financial statements. This process, which relied on sampling, involved examining a subset of transactions as a proxy for the organisation's activities -- it was effective but limited by time and scale.

INET bets on sovereign cloud with B2.5bn expansion

Business, Suchit Leesa-nguansuk, Published on 05/03/2026

» Internet Thailand Plc (INET), a Thai-owned local cloud and digital platform provider, plans to invest 2.5 billion baht to build its fourth data centre in Thailand to tap enterprises' rising demand for data sovereignty.

Feed, milling tech expo lands at Bitec

Life, Published on 05/03/2026

» Industry professionals are invited to the Victam Asia & Grapas Asia 2026 expo, which will take place at Bitec Hall 100-102, Banga Na-Trat Road, from March 10 to 12.