Showing 1 - 10 of 10,000

Local shabu-shabu competition projected to bubble over

Business, Kuakul Mornkum, Published on 21/02/2026

» The shabu-shabu/sukiyaki buffet sector in Thailand is gearing up for more intense competition this year, according to Miracle Planet Co Ltd, an operator of the Lucky Suki and Lucky Barbecue brands.

Petrochemical sector faces stagnant year

Business, Yuthana Praiwan, Published on 21/02/2026

» Thailand's petrochemical industry is expected to confront another flat year, with leading firms pressured to adjust by cutting costs and rolling out value‑added products to stay afloat.

Guru's Weekly Buzz: Feb 20-26

Guru, Published on 20/02/2026

» Guru By Bangkok Post's weekly pick of the most exciting products, activities, food and travel to indulge in.

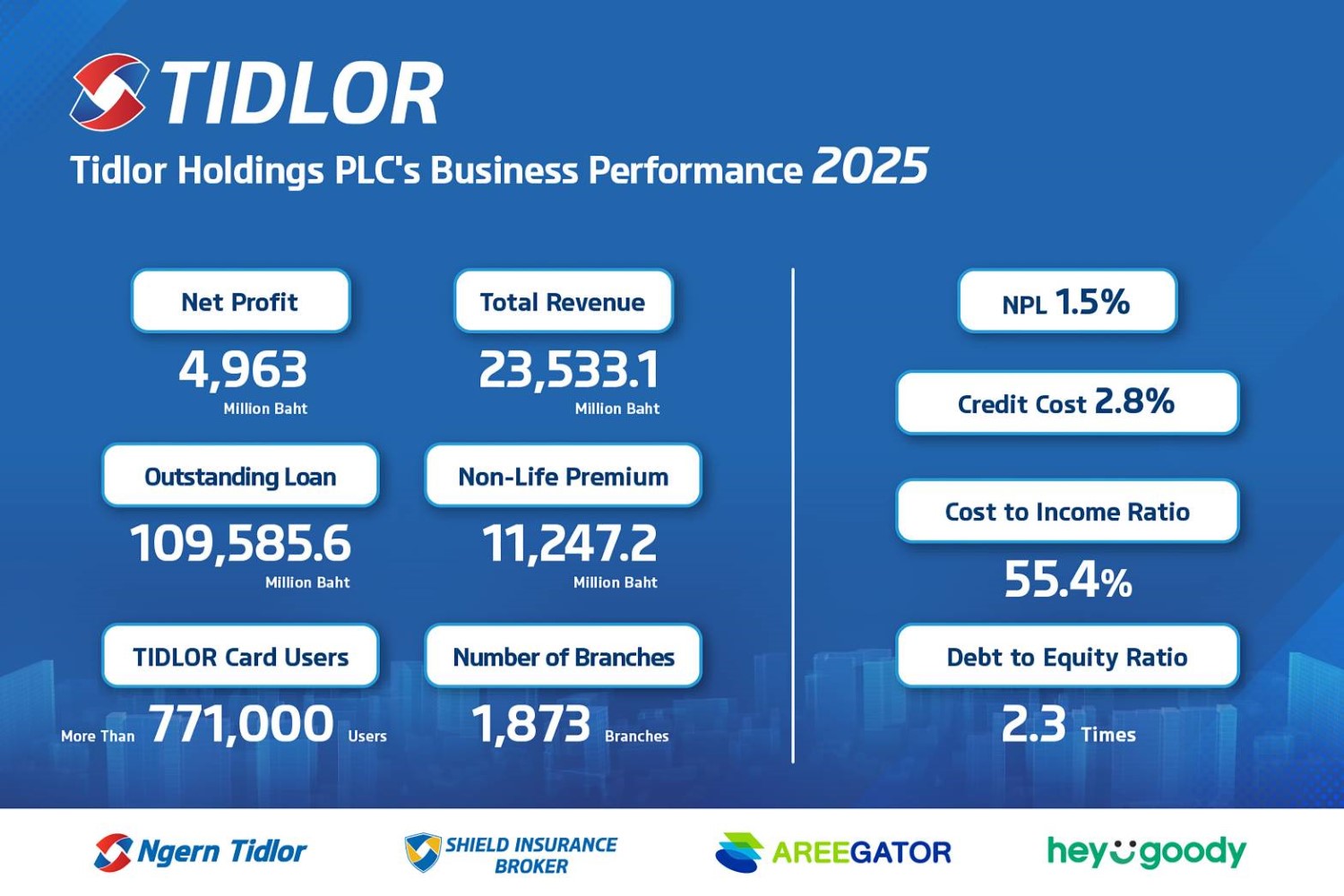

TIDLOR Posts Record 2025 Profit of 4.96bn baht, NPL Falls to 1.5%

Published on 20/02/2026

» Feb 20, 2026 – Tidlor Holdings Public Company Limited (“TIDLOR” or the “Group”) announced its 2025 operating results, reporting a record net profit of 4,963 million baht, up 17.4% year-on-year.

Your horoscope for Feb 20-26

Guru, Chaiyospol Hemwijit, Published on 20/02/2026

» Your spot-on horoscope for work, money and relationship from Guru by the Bangkok Post's famously accurate fortune teller. Let's see how you will fare this week and beyond.

LG Thailand Redefines Home Life with New AI Innovations at ‘LG AI Experience 2026’

Published on 20/02/2026

» Highlights:

China’s drone exports to Russia use a new route through Thailand

Published on 20/02/2026

» On the 30th floor of the Chartered Square building in downtown Bangkok, the low-key office of Skyhub Technologies Ltd serves as a nexus for a burgeoning and contentious trade.

Conveyor belt sushi rises as Japanese dining cools

Business, Kuakul Mornkum, Published on 20/02/2026

» Conveyor belt sushi restaurants in Thailand have growth potential, while the overall Japanese restaurant sector is expected to see flat growth this year, says MAI-listed Maguro Group Plc.

Generali launches health plan with extra 50% coverage for critical illness

Published on 19/02/2026

» Generali Insurance (Thailand) is making a full-scale move into the premium health insurance market with the launch of its new product, “GEN HEALTH PREMIER”, under the concept of Beyond Lump Sum. The plan is designed to go beyond the limitations of traditional lump-sum plans with enhanced premium features, while addressing the lifestyles of consumers who value comprehensive and long-term cost-effective coverage. It targets both customers seeking premium-level health insurance that matches high-end medical services and expatriates working or residing in Thailand who require all-in-one coverage under a single policy. The product is offered exclusively through Generali Insurance brokers only.

Chinese crypto scammer arrested after 2 years in Thailand

Online Reporters, Published on 19/02/2026

» An infamous crypto scammer from China, who masterminded a fraudulent trading platform that led to losses equivalent to 4 billion baht for thousands of victims, was arrested in Thailand on Wednesday.