Showing 21 - 30 of 7,501

Blockchain registrar use under study

Business, Nuntawun Polkuamdee, Published on 16/07/2018

» The Thai Bond Market Association (TBMA) is studying the use of blockchain technology for a bond registrar services platform for corporate bond transactions, with the aim of creating a "Bond Coin" for a swift clearing and settlement system.

GlobalData: Blockchain can help telecoms

Business, Published on 24/08/2018

» Telecom companies need to capitalise on the next billion-dollar blockchain opportunity, says analytics firm GlobalData.

SCG keen to share blockchain

Business, Lamonphet Apisitniran, Published on 21/08/2019

» Siam Cement Group (SCG) is keen to adopt a blockchain solution for its procurement and payment methods, expecting to encourage participation from 2,400 suppliers by 2020.

Blockchain VAT refunds this month

Business, Wichit Chantanusornsiri, Published on 14/11/2019

» The Finance Ministry plans to adopt blockchain-based value-added tax (VAT) refund service for foreign tourists, starting from the end of this month.

Blockchain stands at the precipice

Business, William Hicks, Published on 03/12/2019

» Following the crash in cryptocurrency prices, the future of blockchain remains uncertain, yet enthusiasm abounded at the World Blockchain Summit held in Bangkok on Monday for the potential of this fledgling technology.

Nectec develops blockchain for elections

Business, Suchit Leesa-nguansuk, Published on 03/01/2019

» Thailand can use blockchain technology for elections, with a hybrid model that combines e-voting in close groups and traditional voting, as Thais still need time to build up digital literacy. When 5G is eventually adopted, all voters will be connected, says the National Electronics and Computer Technology Center.

Blockchain suggested for retail banking

Business, Published on 13/11/2018

» Blockchain could revolutionise retail banking by increasing efficiency and expanding options for products and services, says Global Data, a data and analytics company.

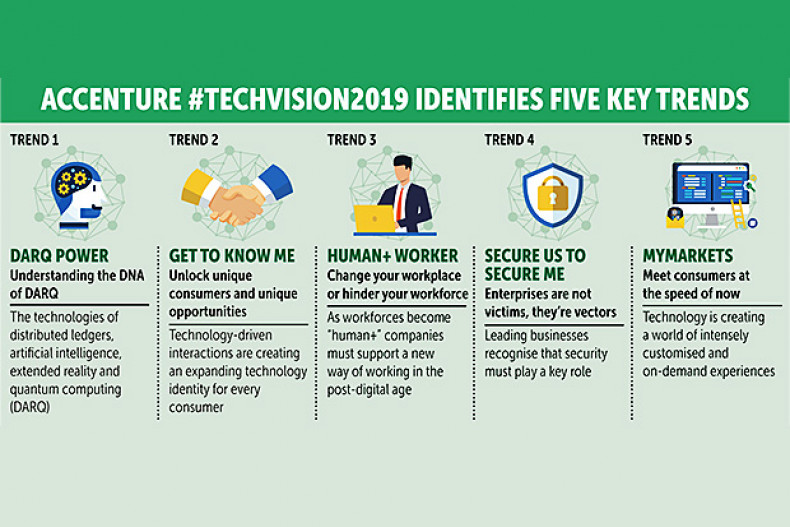

Blockchain tops business trend survey

Business, Published on 30/04/2019

» About a third of Thai executives say blockchain will be the most important new technology for their business over the next three years, according to a survey by Accenture.

KBank tries blockchain option Kubix

Business, Somruedi Banchongduang, Published on 12/04/2021

» Kasikornbank (KBank) is exploring an innovative form of services called decentralised finance (DeFi) using blockchain and independent of central financial intermediaries as it tries to grow its business regionally via the digital platform.