Showing 1 - 10 of 10,000

Youth increasingly targeted as scammers deploy new fear‑based tactics

Online Reporters, Published on 06/03/2026

» Criminal networks are intensifying their focus on young people, using increasingly sophisticated online tactics to extort money, lure victims into criminal schemes and, in some cases, facilitate cross‑border trafficking, the Anti‑Cyber Scam Centre (ACSC) has warned.

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40mn

AFP, Published on 06/03/2026

» KYIV (UKRAINE) - Ukraine's Foreign Minister Andrii Sybiha accused Hungary on Friday of taking "hostage" a group of Ukrainian bank employees who were reportedly transporting US$40 million and nine kilogrammes of gold.

After the raids, Asia’s billion-dollar scam trade flickers back

Published on 06/03/2026

» After only four months in Cambodia, Chen Xian Jin reckons he can spot a scam manager when he sees one. Unlike other Chinese businessmen, they avoid flashy cars and jewelry and keep a low profile.

25% tourism decline ‘worst-case scenario’

Gary Boyle, Published on 06/03/2026

» War in the Middle East could seriously affect Thai tourism this year, with a 25% decline from the 2026 target being the worst-case scenario if the fighting extends beyond three months.

Bitcoin rebounds as conflict in Middle East intensifies

Business, Nuntawun Polkuamdee, Published on 06/03/2026

» Bitcoin has rebounded to top US$70,000 despite escalating conflicts in the Middle East, diverging from most major assets including gold, as global investors move aggressively into US dollars, says digital asset fund manager Merkle Capital.

Iranian warship sunk by US torpedo participated in Indian drill

Reuters, Published on 05/03/2026

» NEW DELHI: The U.S. attack on an Iranian warship in the Indian Ocean this week was the first time since World War Two that the United States has sunk an enemy vessel with a torpedo. The following details are based on accounts from Sri Lankan, U.S. and Iranian officials of the March 4 incident, part of U.S. and Israeli attacks on Iran and its military assets.

Iran war punctures strategy of ‘Sell America, Buy Asia’

Bloomberg News, Published on 05/03/2026

» HONG KONG — The war in Iran is forcing investors to reevaluate one of their most profitable stock strategies, leading some to conclude that the “Sell America, Buy Asia” trade has reached an inflection point.

25% tourism decline ‘worst-case scenario’

Published on 05/03/2026

» War in the Middle East could seriously affect Thai tourism this year, with a 25% decline from the 2026 target being the worst-case scenario if the fighting extends beyond three months, prompting officials to target short‑haul tourists to fill the gap.

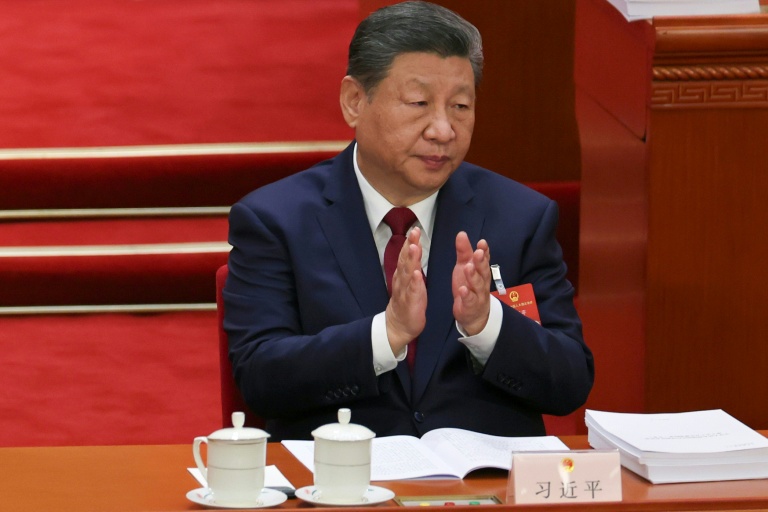

China sets lowest growth target in decades

AFP, Published on 05/03/2026

» BEIJING - China set its annual growth target at between 4.5% and 5% on Thursday, its lowest figure in decades but at the centre of plans to tackle sluggish consumption and a flagging property market.

Singapore police arrest 3 linked to alleged scam syndicate Prince Group

Published on 05/03/2026

» SINGAPORE - Singapore police have announced arrests of three Singaporeans as part of investigations into alleged transnational scam syndicate Prince Group and its founder and chairman, Chen Zhi, who is in Chinese detention.