Showing 1 - 10 of 5,975

More people opting for pets over children

News, Published on 22/02/2026

» Bangkok Post and SIRI Campus on Saturday staged the third edition of the Bangkok Post Forum, "Pet in the City – Smarter Living for City Pets", at SIRI Campus, Sukhumvit 77.

Fewer families lead to local pet craze

Mongkol Bangprapa, Published on 21/02/2026

» Bangkok Post and SIRI Campus on Saturday staged the third edition of the Bangkok Post Forum, “Pet in the City – Smarter Living for City Pets”, at SIRI Campus, Sukhumvit 77.

‘Little reprieve’ for Thailand after US tariff ruling

Published on 21/02/2026

» The issue of US tariffs is expected to intensify now that the US Supreme Court has struck down President Donald Trump’s use of an emergency powers law to impose them, Thai exporters and economists say.

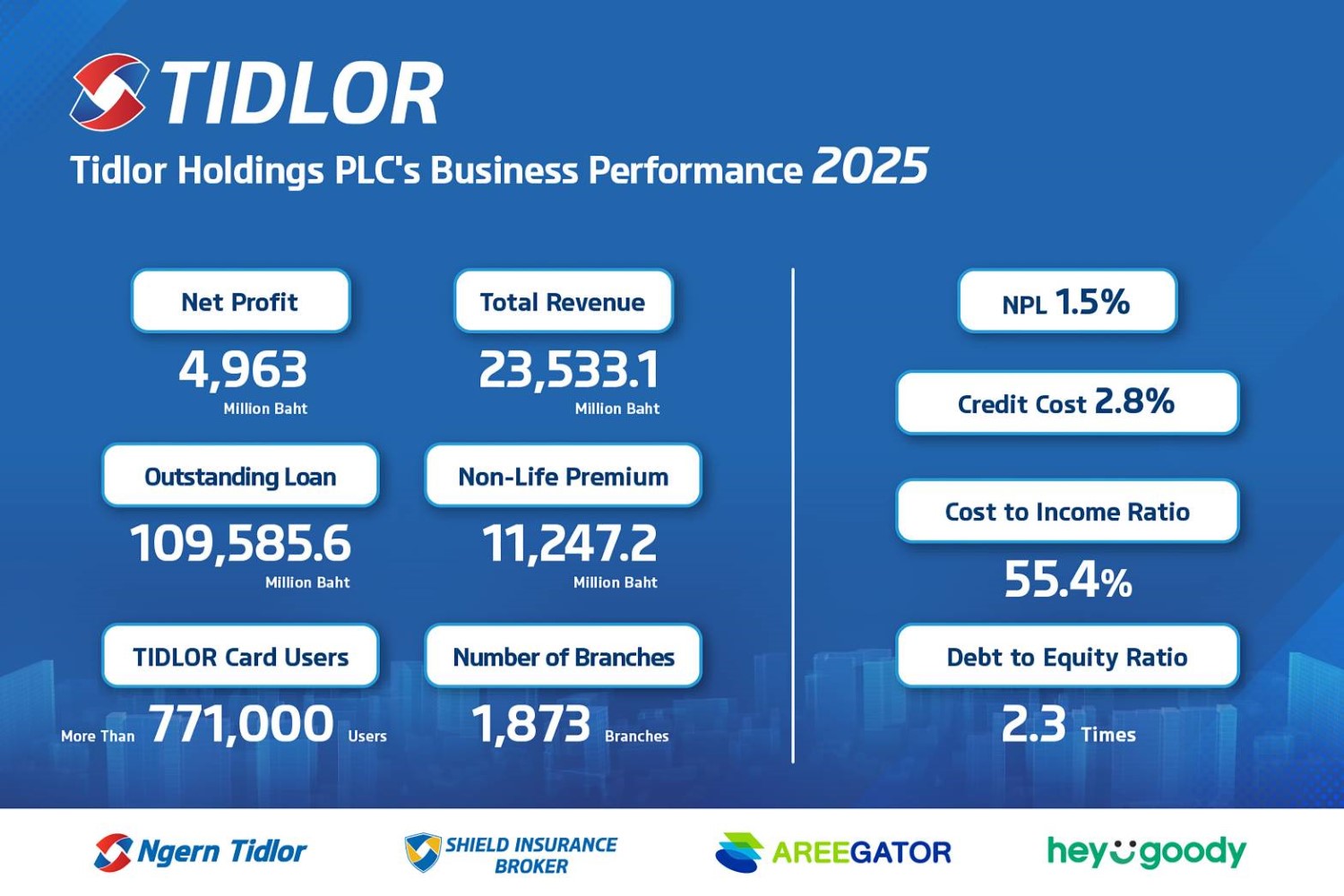

TIDLOR Posts Record 2025 Profit of 4.96bn baht, NPL Falls to 1.5%

Published on 20/02/2026

» Feb 20, 2026 – Tidlor Holdings Public Company Limited (“TIDLOR” or the “Group”) announced its 2025 operating results, reporting a record net profit of 4,963 million baht, up 17.4% year-on-year.

Import duties plunge thanks to strong baht

Business, Wichit Chantanusornsiri, Published on 20/02/2026

» The exchange rate, economic conditions and free-trade agreements (FTAs) have affected import duty revenue for the Customs Department, with collections 8% below target for the first three months of fiscal 2026.

N.C. Housing slashes projects amid weak demand

Business, Molpasorn Shoowong, Published on 19/02/2026

» SET-listed developer N.C. Housing plans to launch only two projects worth a combined 2 billion baht this year, lower than in previous years, as it remains cautious because of weak consumer purchasing power.

Krungsri eyes extra B100bn in SME loans

Business, Nuntawun Polkuamdee, Published on 19/02/2026

» Bank of Ayudhya (Krungsri) has set an ambitious target to expand its portfolio of small and medium-sized enterprise (SME) loans by 100 billion baht over four years, increasing total outstanding SME loans to 350 billion.

Blind to the truth

Oped, Postbag, Published on 19/02/2026

» Re: "DLT to allow online licence renewals", (BP, Feb 17).

Bank of Thailand to monitor KBank after Gulf purchase

Business, Somruedi Banchongduang, Published on 18/02/2026

» The Bank of Thailand is monitoring the increased shareholding in Kasikornbank (KBank) of 10% by Gulf Development Plc, saying KBank will be placed under intensified supervisory oversight.

Kiatnakin Phatra Financial Group plans to expand EV loan portfolio

Business, Somruedi Banchongduang, Published on 18/02/2026

» Kiatnakin Phatra Bank, a subsidiary of Kiatnakin Phatra Financial Group (KKP), wants to grow its electric vehicle (EV) loan portfolio this year, following strong adoption of EVs in the Thai market.