Showing 1 - 10 of 10,000

Gold advances as dip-buyers enter market despite dollar strength

Bloomberg News, Published on 04/03/2026

» SINGAPORE — Gold rose, erasing some of the losses in the previous session, as dip-buyers entered a market fraught with risk on the fifth day of war in the Middle East.

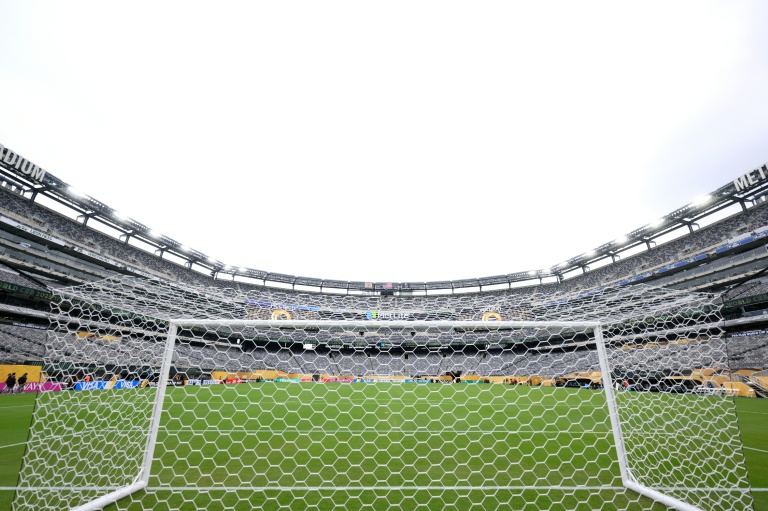

War, politics clouding World Cup on 100-day countdown

AFP, Published on 04/03/2026

» WASHINGTON (UNITED STATES) - Donald Trump's brutal immigration crackdown, polarised politics and a war unleashed on Iran have tarnished the global image of the United States just under 100 days before millions of fans are expected to visit for the World Cup.

Sugar tycoons branch into hotel investments

Business, Kanana Katharangsiporn, Published on 04/03/2026

» The second-generation owners of Rajburi Sugar Group have diversified into hotel investments, spending more than 1.5 billion baht to acquire and renovate Impiana Resort Chaweng Noi in Samui and Pullman Khon Kaen.

Investors urged to buy gold and oil

Business, Nuntawun Polkuamdee, Published on 04/03/2026

» Thailand's leading asset managers are recommending investors increase their exposure to gold and oil as geopolitical tensions in the Middle East intensify, while the country's securities regulator says it is monitoring market stability amid heightened volatility.

Thai massage industry set for overhaul

News, Post Reporters, Published on 04/03/2026

» The Department of Thai Traditional and Alternative Medicine (DTAM) says it is working on a comprehensive upgrade of the country's traditional Thai massage industry.

International school growth nears plateau

News, Jutamas Tadthiemrom, Published on 04/03/2026

» Thailand's decade-long surge in international schools is approaching a plateau, as falling birth rates and demographic shifts threaten to curb expansion in a sector that has nearly tripled in size since 2014.

Navigating new currents: Thailand-US trade after the tariff ruling

Business, Published on 04/03/2026

» The recent decision by the US Supreme Court that President Donald Trump exceeded his authority under the International Emergency Economic Powers Act in imposing broad tariffs marks an important institutional clarification in US trade governance. The court reaffirmed that tariff powers ultimately reside with Congress.

Ships avoid Hormuz as Iran raises threats, conflict spreads

Published on 01/03/2026

» Oil and gas shipping remains largely paused in the Strait of Hormuz that links the oil-rich Persian Gulf to the open seas, as a regional conflict escalates and Iran cranks up threats to vessels transiting through the chokepoint.

Elephant dies for no good reason

Editorial, Published on 01/03/2026

» A wild bull elephant known as Hu Pab died from over-sedation. The tragedy was not an accident, but a failure of a wildlife policy that demands urgent reform.

Govt eyes B3.8bn in export deals

News, Post Reporters, Published on 01/03/2026

» The Commerce Ministry is aiming for nearly 3.84 billion baht in new export opportunities following business‑matching talks with Otis McAllister, a major US importer, as part of efforts to expand Thai food exports amid shifting global trade conditions.