Showing 1 - 10 of 10,000

K-Research upgrades Thai growth outlook

Business, Somruedi Banchongduang, Published on 21/02/2026

» Following a surprise growth result for the fourth quarter of 2025 and an improved performance over the past year, Kasikorn Research Center (K-Research) has upgraded its outlook for the Thai economy.

Anxious Venezuelans seek clarity on new amnesty law

AFP, Published on 21/02/2026

» CARACAS - Families in Venezuela continued to wait anxiously outside prisons Friday, as questions swirled about a newly passed mass amnesty law pushed through by interim authorities following the US toppling of Nicolas Maduro.

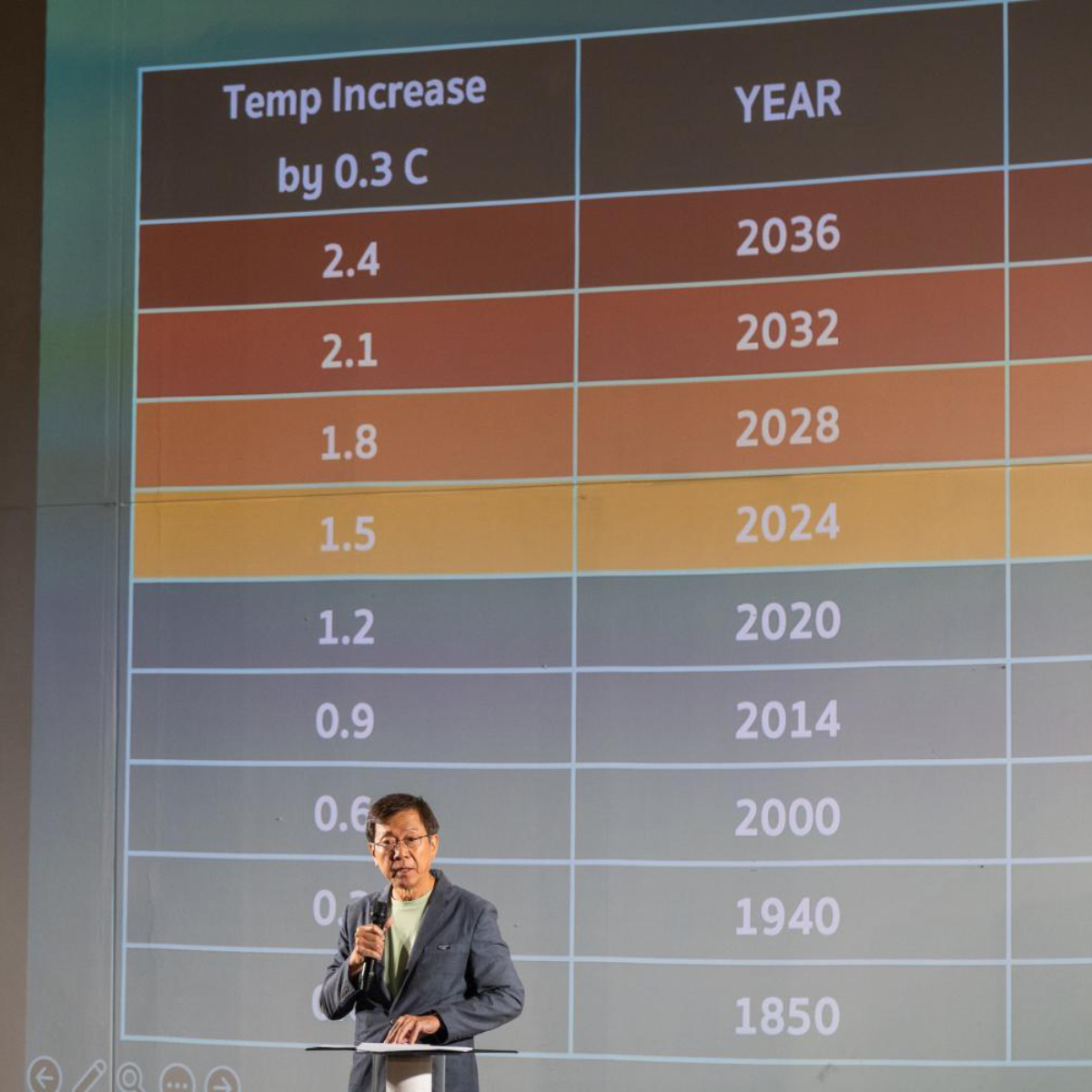

High risk as mercury rises

News, Editorial, Published on 21/02/2026

» On Monday, Thailand will officially enter the hot, or summer, season. The Ministry of Public Health has warned citizens and businesses to prepare for what is expected to be a more severe summer than last year, due to rising global temperatures.

Trump's new Iran threats rattle markets

Business, Published on 21/02/2026

» RECAP: Most Asian equities fell and oil prices rose yesterday after Donald Trump ratcheted up Middle East tensions by hinting at possible military strikes on Iran if it did not make a "meaningful deal" in nuclear talks. The remarks put the brakes on a rebound in markets following an AI-fuelled sell-off earlier.

Origin ramps up non-residential push

Business, Molpasorn Shoowong, Published on 21/02/2026

» SET-listed developer Origin Property aims to increase the contribution of non-residential revenue to two-thirds of total profit within 5-10 years, up from an estimated 50% this year, as it diversifies into hotels, services and warehouses.

Fast-tracking a green future

Life, Published on 21/02/2026

» Pasaya is a sustainable fabric brand and its factory in Ratchaburi is equipped with a wastewater treatment pond, a proper landfill-based waste management method and a proper working environment with ventilation and growing trees.

US GDP growth misses expectations

AFP, Published on 20/02/2026

» WASHINGTON - US economic growth cooled much more than expected in the final months of 2025, government estimates showed Friday, capping the first year of Donald Trump’s return to the presidency.

Thai Union tops the food products industry in S&P Global Sustainability Yearbook 2026

Published on 20/02/2026

» BANGKOK, February 19 – Thai Union Group PCL, a global seafood leader, has been recognised in the S&P Global Sustainability Yearbook 2026, ranking the company in the top 1% worldwide in the Food Products industry with a score of 89 out of 100. The rating is an improvement on the company’s previous score and the highest among Yearbook members listed in the category.

Thai Food Giants Lead Asia in Protein Disclosure, APB100 Finds

Published on 20/02/2026

» Thai companies assessed include Central Plaza Hotel, Charoen Pokphand Foods, Thai Union Group, CP ALL, Thai Beverage, Minor International, Dusit Thani, SnP, MK Restaurants, and President bakery spanning, manufacturing, restaurants, retail and hospitality

ONE Championship: Myanmar’s Vero Nika eyes title mix with KO, bonus at Friday Fights 143

Published on 20/02/2026

» Vero Nika believes she is ready for her biggest test yet in ONE Championship – and perhaps her biggest opportunity.